All Resources

![]()

Employers

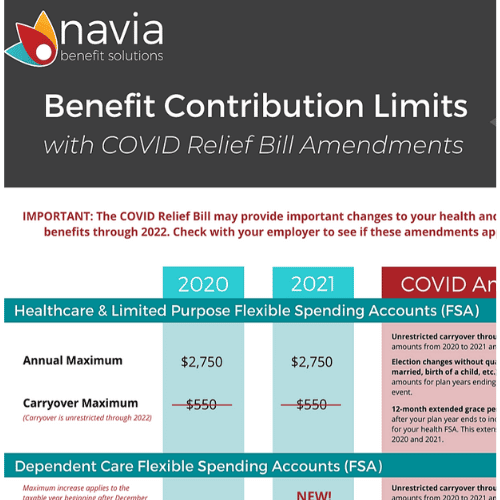

**All materials updated with the latest 2021 ARPA changes**

The U.S. Department of Health & Human Services has extended the National Emergency for an additional 90 days as of July 20, 2021. You can view the announcement here.

Participants

FSA/HRA/HSA FAQs

Below are the compiled questions asked during our live webinar about How ARPA/EBSA Affect FSA/HRA/HSA plans on April 13, 2021. We have separated them into the categories below:

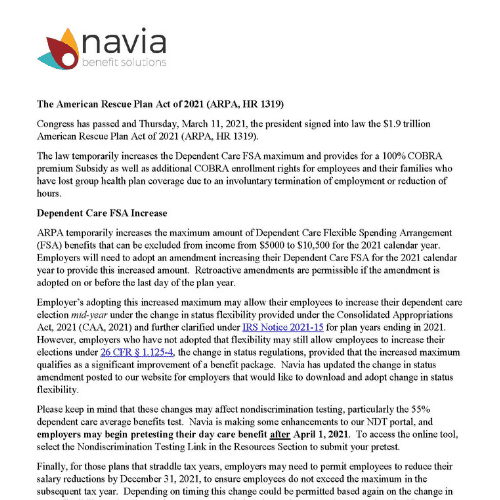

Dependent Care FSA Maximum Contribution Increase

Personal Protection Equipment (PPE)

FSA/HRA Claims Runout Timeline

Non-Discrimination Testing (NDT)

General FSA Questions

Commuter Benefits

Dependent Care FSA Maximum Contribution Increase

Is the $10,500 dependent daycare increase temporary?

As of right now, it is a temporary increase and is only applicable for the 2021 taxable year.

If an employee is not currently using a Dependent Care FSA and would like to do so can they do so under the amendment?

Since this is a significant improvement, employers can allow and enrollment mid-year.

Will Navia have marketing materials we can share with our employees to help them understand the savings if they max their Dependent Care FSA?

We have sent a template participant communication to those employer groups who have amended their plan explaining the benefits of electing the full amount into their Dependent Care FSA. You can also find a copy of that communication on our COVID Resource Hub.

Does Navia anticipate that legislation will extend the new limit of $10,500 for future years or that it will only be for 2021?

At this time, we do not know if they will continue this into 2022.

How are off calendar plans handled with the new limit?

There isn’t a one size fits all answer here, but there are a few things to keep in mind to help you decide the best course of action for your plan –

-

- Whatever your plan anniversary date, you’ll need to keep an eye on total contributions made in the 2021 tax year to ensure that employees don’t over contribute.

- In order to take advantage of the full limit in 2021, employees may need to have a contributions made at an accelerated rate in 2021, and a reduced rate in 2022 to respect the presumed $5,000 limit for that tax year.

- One strategy employers can use to help set some parameters for the 2021 months would be prorating the maximum for your plan year. To calculate a prorated maximum use the tax year limit divided by 12 –

- For any months in the plan year that fall in the 2021 calendar year – $875/month

- For any months in the plan year that fall outside the 2021 calendar year – $416/month

How do I navigate effective date with Navia/ADP setup when allowing DC FSA increases?

If someone was previously enrolled in the dependent care FSA and is increasing their election, Navia will keep the original effective date associated with the election. We can’t comment on ADPs specific capabilities here, but in the event that files pass a revised effective date when an election is increased, in this case, we won’t allow that to overwrite the original effective date.

If we increase the maximum, is it permissible to have a special open enrollment period to have employees enroll?

Yes, you may have a special open enrollment period.

Our plan year is 4/1/21 to 3/31/22. We are open to increasing the DC FSA for the new plan year but not the year that has already ended. Can we do that?

Yes, you could choose to amend just the current plan year.

Is the FSA increase only for daycare, or does it apply to all FSA eligible items?

The maximum contribution increase to $10,500 is only for the Dependent Care FSA.

What happens to unused balance for a non-calendar year plan from April – March?

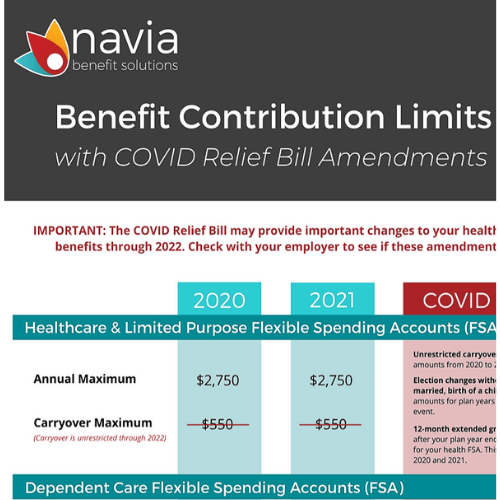

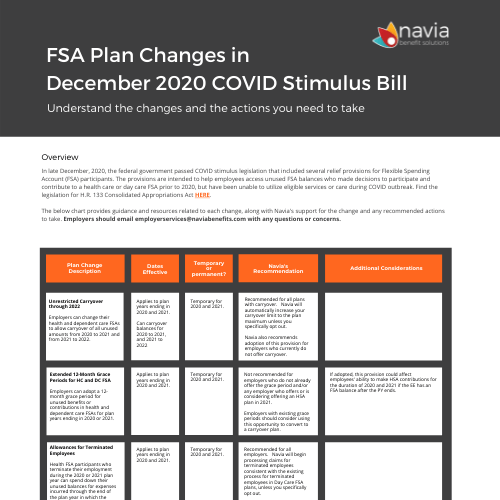

This depends on your plan design. If you elected to amend your plan and take advantage of the 100% carryover provision, plans can carryover remaining balances in the health and dependent care FSA for plan years ending in 2020 and 2021. For the upcoming plan year that will end in 2022 the carryover will be limited to the prior maximum of $550 and will only apply to health FSAs.

Can we limit the DCFSA increase to only employees that are currently participating in the plan, or do we have to open it up to all employees, even if they had not originally enrolled in the plan for 2021?

Amending the plan and increasing the limit would make that change available to all that are eligible to participate in the plan, not just those that are already enrolled.

Will implementing the amendment to Daycare FSA cost more to employers?

There is no fee for Navia to increase this limit for employers.

If an employer opts out of the DC FSA increase, do we know if employees who elect $5,000 can still take advantage of the $5,500 difference by listing expenses when filing taxes?

Not exactly. We do know that the childcare tax credits have been increased in addition to the dependent care FSA maximum increase. Your employees may qualify for those increased limits, but the application of those credits will vary based on things like the number of dependents, income, etc.

If we elect a higher DC Limit and have a carryover for our plan, is there an issue if limit returns to $5,000 in 2022? For example, they elect $10,500 this year and carryover the full amount?

Yes. Assume employee elects 2021 max of 10,500 and carryover 100% into 2022. Any amounts received in excess of 2022 max (assuming it is $5000, could be taxable. See examples in the instructions for form 2441.

Does the unused portion of DCFSA rollover into 2022?

It could, if the plan was amended to take advantage of the 100% carryover feature.

Can you explain how the 2020 DCFSA carryover works and how it relates to the $10,500 increase? Someone with $5000 carryover can elect an additional $10500 or can only elect an additional 5500 for 2021?

Employees can elect up to the max during 2021 but any amounts carried over and received from 2020 in excess of the 2021 10,500 max could be taxable.

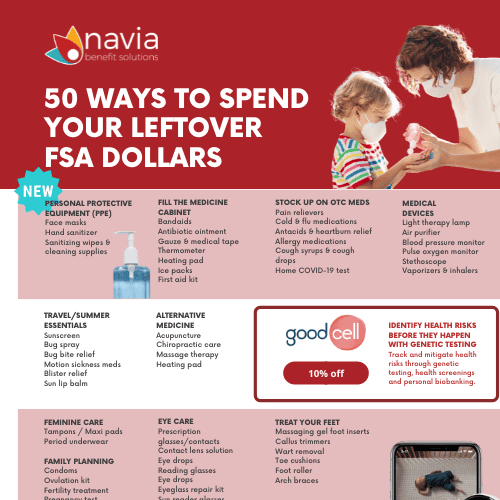

Personal Protection Equipment (PPE)

Can PPE be reimbursed under a Limited Healthcare FSA?

No. A Limited Healthcare FSA only covers expenses for dental and vision services. PPE does not fall within the safe harbor for prevent care list.

Are we required to notify employees of the eligibility of PPE items?

No, it is not required. However, we highly recommend you communicate with your employees that they are able to purchase PPE products with their FSA.

What are the dates for PPE?

FSA participants can submit claims for eligible PPE purchases retroactive back to January 1, 2020.

Are gloves accepted as PPE?

Gloves are not a covered PPE expense.

Are face shields or mask filters considered eligible PPE items?

This isn’t clear yet. As we get clarification on specific products, we’ll share those with clients.

Do PPE expenses from 2020 come out of the 2020 plan year expenses? What about if the claims are submitted after our claims runout deadline, since the info wasn’t available before then?

The service date for PPE expenses would be the date that the items were purchased. Those purchases could be applied to any plan year that is still open for claim submission. Due to the CARES act impact on claims run-out deadline, the majority of 2020 plans are still open for claim submission – even if we’re past your normal claims run-out timing. Reach out to our Employer Services team to confirm claim submission deadlines for your plan.

The IRS regulation states “for the prevention of COVID.” What does this mean as we hopefully approach an end to the pandemic?

For right now, PPE ca confidently be reimbursed as we have a declared national emergency related to COVID-19. It is unclear how that will work after the end of the National Emergency. We will keep you informed as we learn more about the temporary or permanent nature of these items.

Do you have to amend FSA plan to cover PPE or is it automatic?

No amendment is needed as this is a change to the 213(d) list.

Are you reprogramming debit cards to accept PPE or is it up to the merchant?

The industry is already working on review of items considered PPE so that the debit cards may be reprogrammed to recognize these as eligible expenses. We’ll update you when cards can be used to purchase PPE.

Is there a price limit on masks? IE go to Nordstrom and pay $40 for a designer mask – will this be reimbursed under PPE?

As long as the mask is for the primary purpose of preventing the transmission of COVID, cost will not prohibit reimbursement of the item.

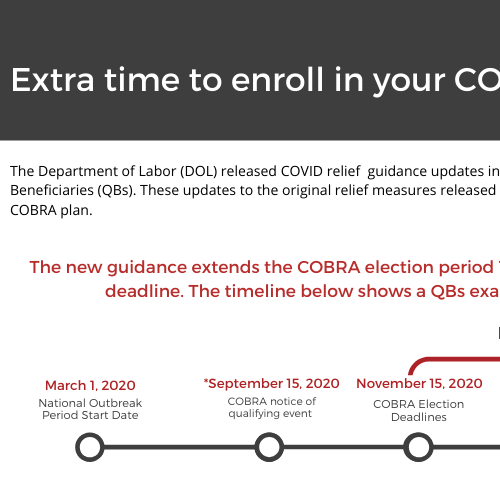

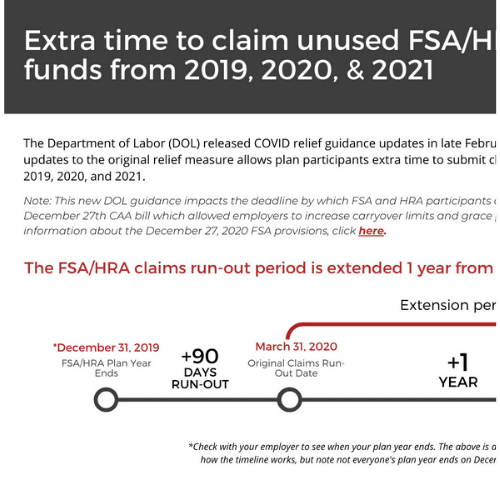

FSA/HRA Claims Runout Timeline

How does the run out vary for current plan years vs. terminated employees? For example if an employee terms would they have the extension after their date of terminations?

This is based upon plan design, but most of our employer structure their plan such that terminated employees have the same claims-run out period as active employees. If the employer adopted the spend down provision of the CAA stimulus bill, terminated employees would also be able to submit claims for expenses incurred after their termination date and be reimbursed up to their contributed balance.

How does the extended run out plus unlimited carryover work together? Are employees just able to submit expenses for both plan years?

Yes! We’ll make their carryover balances available 25 days into the new plan year. This provides employees access to use the funds for both current and prior plan year expenses. We will rollback balances to pay prior plan year claims when necessary.

The extended claims deadline was only if we opted to extend it, it wasn’t a requirement to adopt, was it?

EBSA issued disaster relief notice 2020-01 and 2021-01 that prescribed deadlines during the “outbreak” period, which means certain actins needed to be take by the earlier of 1 year from the deadline or 60 days after the end of the national emergency. This relief applies to the claims run-out period for most employers (even government entities like cities and counties were encouraged to abide for example).

The extensions help participants use their funds but it didn’t change the dates that the expenses had be incurred, correct? For example for plan year 2020, participants have until whatever time to file the claim but the expense still had happen in 2020 for the date of service, right?

Correct. The CARES Act didn’t extend the ability to incur expenses beyond a plan’s original deadline. However, there were changes announced that allowed larger amounts to carryover into subsequent plans year and extensions of the grace period feature that were aimed at providing different ways for employees to spend their balances.

Our 2020 funds were moved into the 2021 account, does the Dec 16th due date still apply?

The December 16th deadline discussed during the webinar to help illustrate timeframes, but is not a true deadline at this point. Any funds that were carried over from a 2020 plan year into a 2021 plan year would be subject to the run-out deadlines and carryover options available on the 2021 plan year.

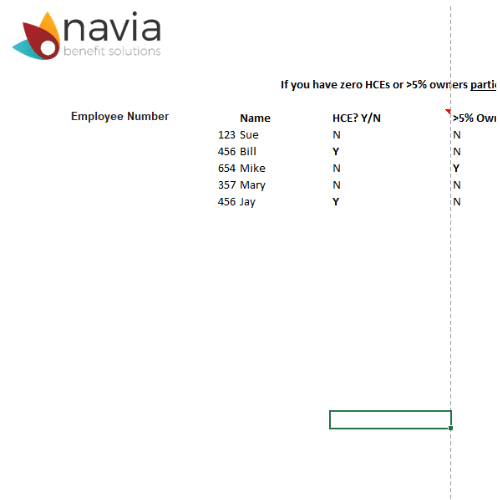

Non-Discrimination Testing (NDT)

If you fail NDT because you increase the $10,500 would we just add a pro-rata amount of taxable wages back to the Highly Compensated Employees until we passed? Would Navia assist with this process?

If your plan does not pass non-discrimination testing for the dependent care FSA Navia is happy to assist with calculating the threshold for highly compensated employees needed for the plan to pass.

Are you finding employers are failing testing more frequently when adopting the higher DCFSA limit verses those who do not?

We don’t have enough information at this time to say if employers are failing more frequently at the $10,500 limit compared to the $5,000 limit. It is a possibility that we want to keep clients aware of so clients don’t end up surprised by this when they complete their end of the year testing.

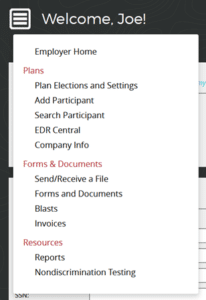

Where on the site is the pre-test?

All testing, pre-testing and year end, is available through the employer portal. Once you have logged in, navigate to the “Nondiscrimination Testing” portion of the site through the main menu.

We have had to terminate our DC FSA program because we do not pass our NDT. Are there any changes regarding highly compensated employees?

Unfortunately, no.

Is NDT for Dependent Care FSA based on actual participants or the entire population?

There are two available methods for testing your plan. One method tests based on your entire eligible population and the other tests based on only those enrolled. The more conservative interpretation is to test against the entire population and assume those not participating have a zero dollar election.

For LLCs how do owner’s children that work there get handled?

If the LLC files their federal taxes as a partnership then those individuals are not eligible to participate.

Do you anticipate many employers declining to adopt the Dependent Care FSA increase due to NDT concerns?

This will likely depend on the individual employer’s past experience with NDT. If they have high numbers of highly compensated employees or have had difficulty passing this portion of the test employers may choose not to amend.

General FSA Questions

Regarding the DCFSA carryover and the FSA carryover unlimited provision, for off-calendar plan years, does this apply only for plan year that begins in 2020 and 2021? Or does it all end 12/31/2022 no matter when the plan year starts?

The carryover provisions included in the CAA stimulus bill earlier this year apply to plans with end dates in 2020 or 2021. The end date would be specific to the plan that was amended.

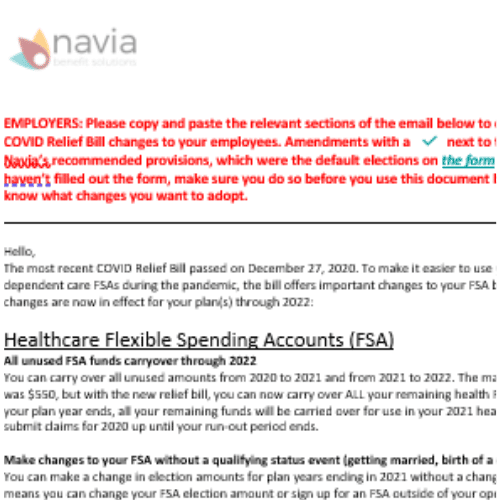

Are feminine products and OTC meds a required specific amendment to our plan?

Amendments are not required to take advantage of these newer expense types.

Can employees make changes to their FSA contributions any time of the year now, or do they still need a qualifying life event to make a change?

Change in status rules limiting when plan participants can change their elections would still apply, unless the plan was amended to allow unrestricted election changes. This provision of the CAA stimulus bill is available to plans ending in 2020 or 2021. If you would like to amend, you can access a copy of the applicable amendment from our COVID resource HUB.

Commuter Benefits

Can you go into the commuter benefits flexibility?

There was recent clarification of existing commuter benefit rules that would permit an employee to move funds contributed to another benefit offered under the commuter benefit. For example, and employee with unused funds in a transit benefit could move those funds to a parking benefit for use with parking related expenses as long as they don’t exceed the monthly limit of $270.

COBRA FAQs

FAQs Coming Soon!

COBRA Qualified Beneficiary FAQs

FAQs Coming Soon!

Virtual healthcare can help employees avoid exposure and the spread of disease.

Employees save $517 in healthcare costs every time Teladoc is used and employers save $2 for every $1 invested. Download Navia’s Telehealth datasheet and learn more.

Struggling with layoffs? Navia’s Direct Billing service could help with leave-of-absence.

Navia’s Direct Billing Services remove the burden of collecting premiums from members who cannot have funds deducted through payroll. Download Navia’s Direct Billing datasheet and learn more.

Navia’s Direct Billing Services remove the burden of collecting premiums from members who cannot have funds deducted through payroll. Download Navia’s Direct Billing datasheet and learn more.