New IRS Guidance

The Internal Revenue Service (IRS) recently released Notice 2020-29 and Notice 2020-33 dealing with mid-year election changes, grace periods, and FSA carryover.

Quick overview of the key changes:

- Mid-year election changes for group health coverage for the remainder of the 2020 plan year without a qualifying status change event. While Navia does not administer group health plans, we think that this change is broadly beneficial and helps employees adjust their health coverage in accordance with unforeseen medical needs or changes in their financial status.

- Mid-year election changes for healthcare and day care FSAs for the remainder of the 2020 plan year without a qualifying status change event. While mid-year changes to DCFSAs have always been permissible for parents whose day care and school arrangements have been impacted by COVID, the relaxation of changes to HCFSA elections further helps employees address medical and financial need. This change also allows participants enroll or increase their election to take advantage of the newly-eligible over-the-counter medication and menstrual care items as provided through the CARES Act.

- Extension of the FSA Grace Period through December 31st, 2020. Employers may now extend the normal 2.5 month FSA grace period through year-end, allowing FSA participants to incur expenses and use funds available through the grace period for the entire year.

- Permanent increases to the FSA Carryover amount and indexing it to the plan maximum. For plans beginning in 2020, this raises the ceiling on the amounts that FSA participants can carryover into the next plan year, and reduces the likelihood of forfeiture for certain participants.

Unlike the previous CARES Act and DOL changes, the IRS notices are not mandatory, and employers can choose whether or not to adopt these provisions within their plans. If you choose to adopt these new provisions, you must execute a plan amendment for each change and return it to us at employerservices@naviabenefits.com before the changes will be enabled in our systems.

Plan Amendments

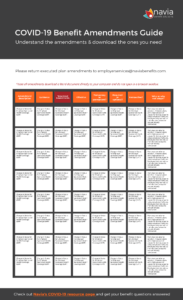

Click here to download our complete COVID-19 Plan Amendments Guide with links to individual plan amendments for each change. Everything you need in one place!

Click here to download our complete COVID-19 Plan Amendments Guide with links to individual plan amendments for each change. Everything you need in one place!

Each amendment includes: 1) a plan amendment, 2) a resolution, and 3) a summary of material modifications. Employers adopting these amendments must complete the first page, execute the resolution (depending on the employer’s formalities), and distribute the last page (the summary of material modifications) to all plan participants. Employers adopting the new change in status rules, grace period extension, or the carryover increase/indexing must return a completed copy of the amendment to Navia by emailing it to employerservices@naviabenefits.com. Employers adopting any other amendments do not need to return copies to Navia, but may do so if they wish for us to retain a copy on the employer’s behalf.