What is a Limited Healthcare FSA?

A Limited Healthcare FSA is a pre-tax benefit account that works with a Health Savings Account (HSA), allowing employees to set aside money to pay for qualified dental and vision expenses. Funds put into the plan avoid both Federal Income Tax and FICA, creating a tax savings for both the participant and the employer!

Participant Features

- Navia Benefits Debit Card for easy healthcare payments

- Online portal and MyNavia mobile access to balances and transactions

- Recurring claim submissions

- Connect your bank account for electronic reimbursement – no checks

- FlexConnect to manage dental, and vision expenses

- Customer service online, by email, or by toll-free call

Employer Features

- Secure and easy file-based or online administration

- Analytics and campaigns to encourage participation

- Online and downloadable reports

- Coordinates with HSA for vision and dental expenses

- Dedicated implementation manager

- Full compliance with federal and local regulations

- Plan documents and materials to increase enrollment

- Responsive and experienced employer service team

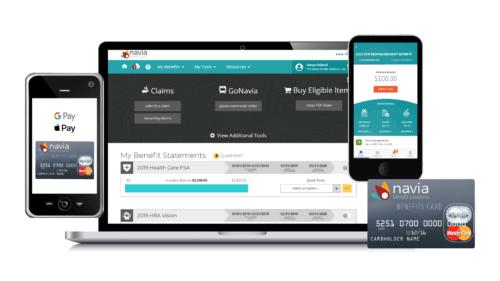

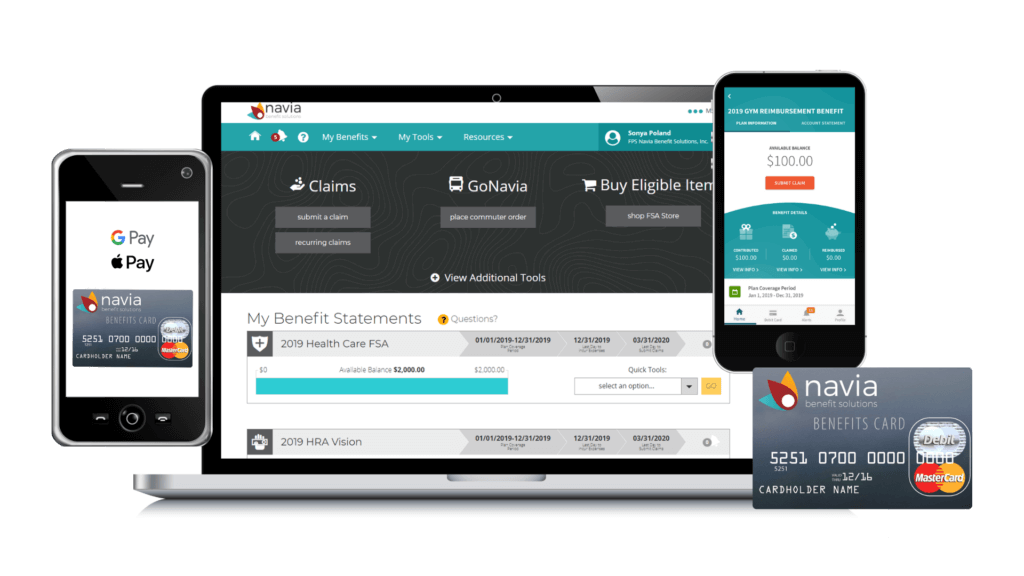

User Experience

Smart technology for a better benefit experience.

We know well-designed technology can make administering your benefits easier and improve employee satisfaction. Navia’s proprietary technology works across all our solutions to make your day easier and improve everyone’s benefit experience.

- Employer and Participant Portals

- Navia Benefits Debit Card

- Mobile App

- Mobile Pay

Unparalleled service, no matter where you are.

Navia serves 7,000+ employers across all 50 states. We have 30 years of experience serving the benefits industry and we are committed to providing unparalleled service to our brokers, employers, and participants.

Open Enrollment Support

Navia’s clients who participate in our OE webinars see an average 6% increase in enrollment, and clients who participate in our email campaign see an average 15% increase!

Check out our Navia Benefits Academy for our robust open enrollment program to help increase your enrollment year over year!

Interested in learning more?

Contact our sales team at 425.452.3498 or sales@naviabenefits.com

What is a Limited Healthcare FSA?

A Limited Healthcare FSA is a pre-tax benefit account that works with your Health Savings Account (HSA), allowing you to set aside money to pay for qualified dental and vision expenses.

Who and What is Covered?

It covers you, your spouse, and eligible dependents!

There are hundreds of eligible expenses for tax-free purchase with your Limited Healthcare FSA funds. Some common eligible expenses include doctor’s office copays, deductibles, routine dental and eye care, glasses and contacts, dental and vision surgeries, and orthodontics. Click here for a full eligible expense list.

How Does it Work?

- Estimate your annual election. During your open enrollment, use the FSA calculator to estimate your out-of-pocket dental and vision expenses for the plan year. This will help you determine your annual election amount.

- Monthly paycheck deductions. The amount you elect will be deducted evenly out of each paycheck on a pre-tax basic and put into your Limited Healthcare FSA. You cannot change your annual election amount after the start of the plan year unless you have a qualified change in status.

- Funds are available immediately. Once you are enrolled, you have access to your funds immediately. Claims can be submitted online or through Navia’s mobile app

- Pay and submit claims! Claims can be submitted online or through Navia’s mobile app. Some Navia plans also offer a debit card, which is your fastest way to pay and avoid a claim

Accessing Your Benefits

Navia Participant Portal

Get 24/7 access to your benefits with the Navia Participant Portal. Submit claims, view account balances and history, get alerts and notifications, request additional debit cards, access our customer service, and much more!

Navia Mobile App

Whether you’re at the doctor’s office or on vacation, the MyNavia App allows you to manage and access your benefits right from your smartphone! Available for iPhone and Android devices, the MyNavia App is a free-to-download and free-to-use tool for any Navia participant.

Navia Benefits Debit Card

Just swipe your Navia Benefit Card to pay for eligible healthcare expenses. Funds come directly out of your FSA and are paid to the provider. Some swipes require us to verify the expense, so hang on to your receipts! If we need to see it, we will send you a notification.

Navia Mobile Pay

Mobile Pay is also available for any participant that has the Navia Benefits Debit Card. Add your Navia Benefits Debit Card to your online wallet and begin paying for eligible expenses with your digital wallet! Learn more here.

Deadlines & Extensions

The Limited Healthcare FSA is subject to the “Use-It or Lose-It” rule. This means that if you do not use all of your annual election within the plan year, the remaining funds are not refundable to you. Fortunately, very few participants forfeit money in an FSA, and the IRS has relaxed the rules in recent years to make it easier for FSA participants to avoid forfeiture.

Some plans include features that extend deadlines and roll over funds.

- Run-out period

- The run-out period is how long you have to file a claim for medical costs incurred during the plan year and during the grace period following the plan year. Run-out periods vary by employer and typically last 60 to 90 days after the end of the plan year.

- Carryover

- The Carryover feature allows participants to roll over up to $660 from one plan year to the next. Any funds above the threshold would be forfeited. This is an optional feature, so check your employer’s plan design to see if the Carryover is included.

- Grace period

- The Grace Period gives you an extra 2.5 months at the end of the plan year to incur expenses against your FSA balance. This is an optional feature, so check your employer’s plan design to see if the Grace Period is included.

Check your employer’s plan design to see if a Carryover or Grace Period feature is part of your plan.

Questions?

Check out our Navia Benefits Academy or Help Center.