How does it work?

You and your employer can contribute tax-free dollars into your Navia HSA throughout the year, up-to the annual individual or family limit set by the IRS. The funds in the HSA can be used to pay for your out-of-pocket medical expenses.

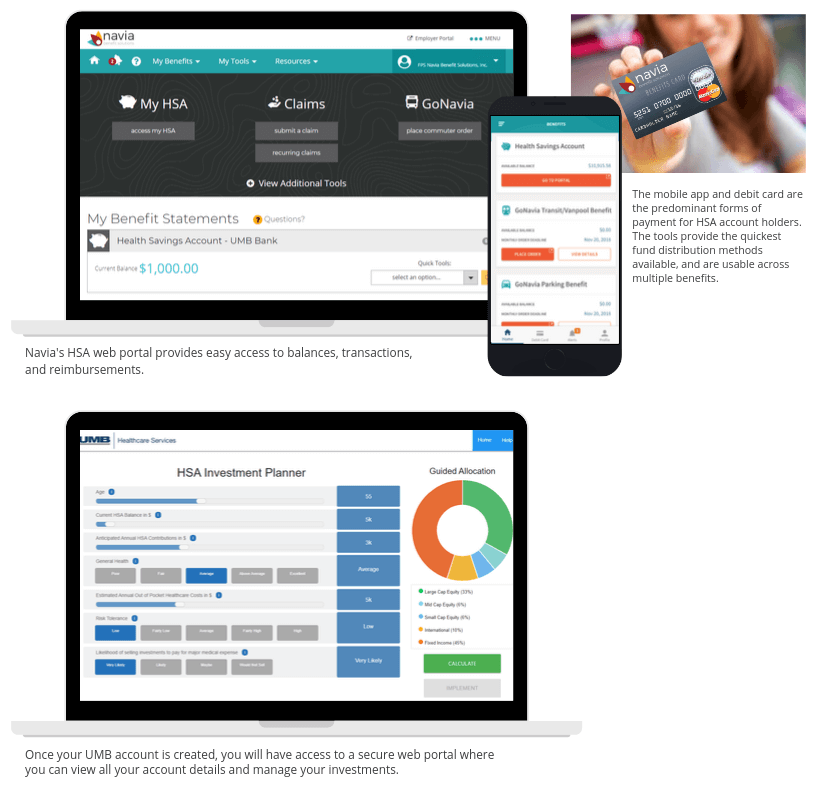

Once you enroll into the Navia HSA, an account will be created for you at UMB Bank and you will be given access to a secure, easy-to-use web portal. Through this portal you can track your account balance, view your investment accounts, and submit requests for reimbursement.

You’ll also receive a Navia Benefits Card that you can use to pay for qualified medical expenses!

Navia HSA features

- Low investment threshold to maximize HSA growth

- Navia Benefits Card for easy healthcare payments

- Billpay for one-time or recurring provider bills

- Online or mobile access to balances and transactions

- Connect your bank account for automated reimbursements or additional contributions

- Medical expense tracking

- Easy transfers from other HSAs to your Navia HSA

- Customer service online, by email, or by toll-free call

Banking details

UMB

Demographics and general information

Company overview: Mid-sized commercial bank with $14.2B in assets under management, branch footprint primarily in the Midwest across 10+ states. 3,600 employees. Many diversified consumer and institutional lines of business, originated in Kansas City by the Kemper family in 1913.

Benefit offerings: UMB Healthcare Services is a dedicated line of business offering HSAs and healthcare payment solutions across multiple consumer and employer channels.

Product: Employer/employee benefit offerings; retail product available to employers, individuals, and payers/TPAs branded as the UMB HSA Saver; white-label solution offered through Alegeus.

Savings and investment features

Interest paid on deposit accounts:

Tier 1: Balance $0 to $1,999.99 – 0.10%

Tier 2: Balance $2,000 to $9,999.99 – 0.20%

Tier 3: Balance $10,000 to $24,999.99 – 0.35%

Tier 4: Balance $25,000 and higher – 0.45%

Minimum balance threshold to invest: $1000

Investment advisor: Devenir

Number of available fund options for investments: 36

List of available funds: https://hsainvestments.com/fundperformance/?p=515

Participant/account holder fees

Monthly investment service fee: $2.50

Returned deposit item: $15

Paper checks (25): N/A

Paper statements: $1.50/month

Closing/transfer fee: $25

Stop payment: $0

Check reimbursement: $0

Check copies: $0

Wire transfer: $0

Debit transactions: $0

Overdrafts: $0

Taben transition instructions

On January 1st, your existing Taben HSA will no longer be accessible. We will automatically open a new Navia account on your behalf and begin transferring your balance once you provide consent. You must provide consent in order for us to take action on your behalf. If you do not provide consent by December 31st, a check in the amount of your remaining balance will be sent to your address on file, with instructions on how to avoid taxable consequences.

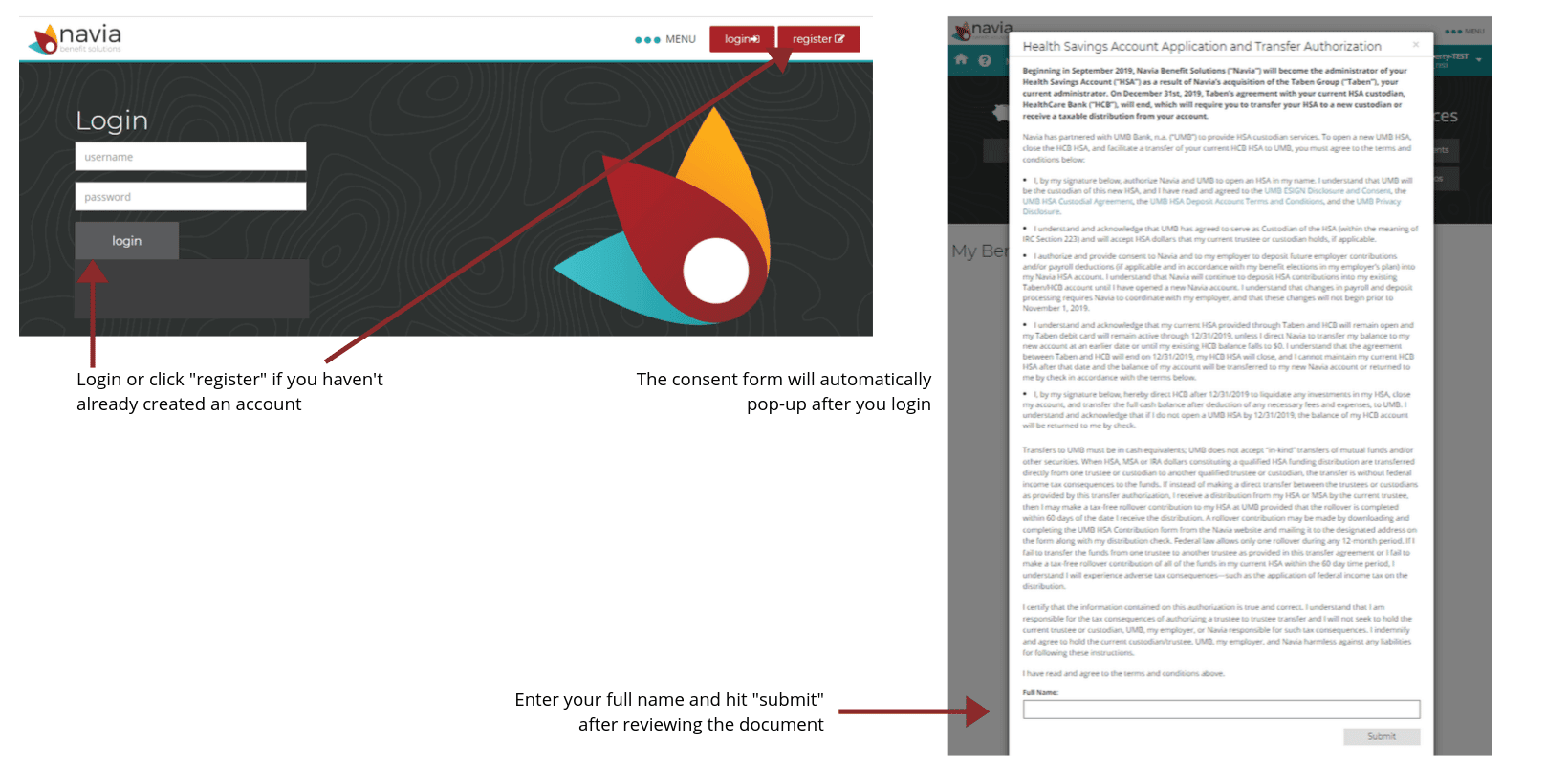

Giving consent is easy

- *Register or login to the Navia portal

- Review the consent page that appears after you register or login

- Enter your full name at the bottom of the consent page and hit “submit”

*You will need your three-character employer code to register. This is listed in the “Taben/Navia HSA Transition Details” email you should have received the week of Oct. 8. and in the printed postal mailing sent that same week. It is also printed on the face of your Navia Benefits Debit Card–if you have already received one. If you cannot find your code, please contact customer service toll-free at (866) 987-0031, or email service@naviabenefits.com.

What happens next?

What happens next?

Navia is waiving all fees associated with Taben account closures and transfers. Once you provide consent, we will begin the process of opening your new account and transferring your existing balance. We’ll notify you when these steps are complete. If you choose not to provide consent to open a new account and execute a transfer, simply dismiss the consent page by clicking the “X” that appears in the upper right corner. You will continue to have the option to provide consent through December 31st, after which we will issue you a check as described above.

After December 31st and/or as Taben HSA account balances diminish to $0, we will also automatically manage the process of account closure and balance transfer from Taben/HealthCare Bank to Navia/UMB. After a participant’s Taben HSA account is closed, any remaining balances will be automatically transferred and deposited to their new Navia HSA. Participants should expect to see the transfer into their new account within 10-14 business days after their Taben account is closed.

Participants who do not open a new Navia account by December 31st will receive a check in the amount of their remaining balance. To avoid taxable consequences associated with a distribution of your HSA balance (income taxes on the amount, plus a 20% penalty), you can do either of the following:

- Within 60 days of the date on your check, execute an HSA “rollover” by opening a new Health Savings Account and sending the check to your new bank according to their rollover instructions. To open a new Navia HSA, you can still follow the instructions above to access the Navia website and open a new Health Savings Account through UMB. The consent language described above will remain in place until March 15, 2020. After your account is open, you will need to download the UMB HSA Individual Contribution Form (downloadable from the Navia site), complete the form as instructed, and mail it with your check to the address on the form.

- In 2020, pay for health care goods and services in an amount greater than or equal to the amount of your distribution check. You should maintain copies of your bills and purchase receipts as backup for the amounts that you declare on your 2020 income tax return.

Taben transition FAQs

Why is my HSA changing?

In April, 2019, Taben Group and Navia Benefit Solutions announced a partnership whereby Navia acquired Taben as a fully-owned subsidiary. The relationship between Taben Group and its existing HSA custodian (Healthcare Bank) will end on December 31st, 2019, and all current accountholders have the option of opening a new Navia HSA account beginning in October, 2019. Until you open a Navia HSA, your existing HSA through Taben Group will remain active and you should continue to use your Taben Group debit card. After you open a Navia HSA, your old account will be closed, and any remaining balance will be transferred to your new account within 10-15 business days.

Who is Navia?

Navia Benefit Solutions, Inc. is a leading and one of the fastest-growing providers of consumer-directed benefits (HSA, FSA, HRA, wellness incentives, commuter benefits, and COBRA) in the country, headquartered in Renton, WA (near Seattle) with offices in Michigan, Kansas, and California. Founded in 1989 as Flex Plan Services, Navia has nearly 30 years of experience administering consumer-directed benefit accounts and serves employers of all sizes across the United States. More information on the company and its products and services is available at https://www.naviabenefits.com.

What is the Navia HSA?

Similar to the Taben Group HSA, the Navia HSA is one of the most tax-efficient benefits available to save and spend on eligible health care products and services. In partnership with UMB, one of the largest and most experienced banks with HSA accounts in the United States, Navia offers tools and investment options to make it easy for HSA participants to pay for health care and to save for future health care expenses. The Navia HSA offers competitive interest rates on cash deposits, a broad and quality portfolio of investment options to promote long-term savings, a low cash balance requirement ($1000) before you can begin investing, and planning tools to help you make informed choices about your contributions and your investment plan.

How do I open a Navia HSA?

To open a Navia HSA, all you need to do is the following:

- *Register or login to the Navia portal

- Review the consent page that appears after you register or login

- Enter your full name at the bottom of the consent page and hit “submit”

*You will need your three-character employer code to register. This is listed in the “Taben/Navia HSA Transition Details” email you should have received the week of Oct. 8. and in the printed postal mailing sent that same week. It is also printed on the face of your Navia Benefits Debit Card–if you have already received one. If you cannot find your code, please contact customer service toll-free at (866) 987-0031, or email service@naviabenefits.com.

We’ll automatically begin the process of opening your new account, and you’ll receive confirmation when your new account is ready for use. Because of federal banking regulations, UMB must verify your identity against federal and state regulatory systems and other trusted sources of identity. In rare cases, your name may not match against one or more of these sources, and you may receive a request from UMB to provide additional documentation in order to open your account. You should supply the information as requested to expedite the activation of your account.

Will I be charged any fees as a part of this migration?

No, Navia is waiving/absorbing all fees related to the transition of your account.

Can I continue to use my Taben HSA? When will my money be transferred to my new account?

Yes, your Taben HSA and debit card will remain active until you open a Navia HSA. Afterward, we’ll automatically close your existing Taben account and transfer any remaining balance to your new account, at which time you should begin using your new Navia debit card for eligible health care expenses.

When your old account is closed, you’ll receive an automated closure notification from your prior HSA custodian. You should disregard any language in the closure notice that states that you will be receiving a check – we will automatically transfer your balance to UMB. Balance transfer timing is dependent upon bank processing and mail times, but should expect to see your funds deposited into your account no later than 10-15 business days.

What if I do nothing by December 31st?

Participants who do not open a new Navia account by December 31st will receive a check in the amount of their remaining balance. To avoid taxable consequences associated with a distribution of your HSA balance (income taxes on the amount, plus a 20% penalty), you can do either of the following:

- Within 60 days of the date on your check, execute an HSA “rollover” by opening a new Health Savings Account and sending the check to your new bank according to their rollover instructions. To open a new Navia HSA, you can still follow the instructions above to access the Navia website and open a new Health Savings Account through UMB. The consent language described above will remain in place until March 15, 2020. After your account is open, you will need to download the UMB HSA Individual Contribution Form (downloadable from the Navia site), complete the form as instructed, and mail it with your check to the address on the form.

- In 2020, pay for health care goods and services in an amount greater than or equal to the amount of your distribution check. You should maintain copies of your bills and purchase receipts as backup for the amounts that you declare on your 2020 income tax return.

If you have further questions or require assistance, we’re here to help. Please feel free to reach us at customerservice@naviabenefits.com or call toll-free at (866) 987-0031.