On June 24, 2022, the U.S. Supreme Court upheld Mississippi’s restrictions on abortion, a ruling that may lead employers to revise their employee health care benefits to include medical travel benefits.

The SCOTUS decision overturns Dobbs v. Jackson Women’s Health Organization, Roe v. Wade (1973), and Planned Parenthood of Southeastern Pennsylvania v. Casey (1992) decisions that pre-empted state restrictions on abortion. This means that states now have the power to pass laws banning or restricting abortion services. With this change employers may want to look at information on their group health plans and benefits for options that will allow them to support employees who need to travel to seek medical care out of state.

The information below provides an overview, and due to many changes in the legal rulings that are unknown at this time and are anticipated to continue throughout the next few months from states, we will be updating as additional information becomes available.

Group Health Plan Coverage Governance

It is prudent for employers to understand the impact federal and state laws may have on group health plans and coverage that may be provided. Coverage under fully insured plans is typically governed by State Insurance Laws, check with your fully insured provider on any impact to your insured group coverage. Coverage under self-insured plans is typically not subject to State Insurance Laws which may provide more flexibility of coverages provided, but are subject to ERISA, the Employee Retirement Income Security Act. There are other federal and state laws that may apply. Guidance from your providers and legal counsel is recommended to determine what laws are applicable to your benefit offerings.

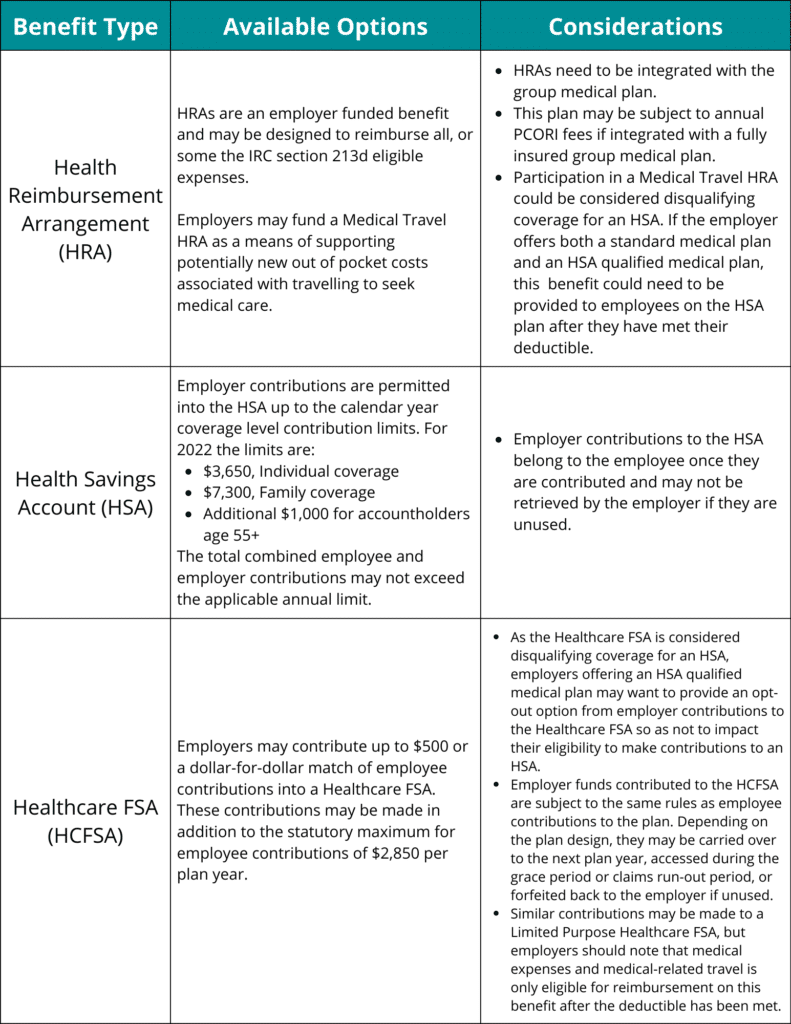

Reimbursement for Medical Travel Services from Consumer-Drive Healthcare Plans

Medical Travel services are considered eligible expenses per IRC section 213(d), this means that they would be included by the plan in a Healthcare Flexible Spending Account (HCFSA) and Health Savings Account (HSA) as an eligible medical expense. Some Health Reimbursement Arrangements (HRAs) may limit IRC section 213(d) expenses. Employers can determine their current coverage by reviewing their Plan Documents and Summary Plan Descriptions. All reimbursements must comply with plan limits which are governed by regulations and/or plan sponsors. Additional information regarding these plans can be found in Publication 968.

Travel Costs Associated with Medical Care

As the need to travel for medical services increases, if an individual resides in a state where certain medical services may be restricted, increased cost to travel for these services could financially hinder the individual. Many companies over the last few days have added medical travel benefits to their benefit package to help with these expenses. Medical travel benefits could cover the following expenses for individuals who would need to travel to receive medical services*:

- Ground transportation, such as bus, taxi, or train

- Airfare

- Lodging ($50/night for individual, or up to $100/night if traveling with a companion)

- When using a personal vehicle for travel, the total of any associated parking fees, tolls, gas, or oil may be reimbursed -or- mileage can be reimbursed for each mile associated with the medical travel. (Standard mileage rate is $0.18/mile for the first half of 2022. Effective July 1, the mileage rate increased to $0.22/mile.)

*The Employee Retirement Income Security Act of 1974, as amended (ERISA) Section 733(a)(2) defines medical care to include “the diagnosis, cure, mitigation, treatment, or prevention of disease, or amount paid for the purpose of affecting any structure or function of the body,” and includes amounts paid for transportation primarily for and essential to medical care (as described) and amounts paid for insurance coverage of the same.

Considerations and Actions Employers Can Take

Employers looking for additional ways to provide access to medical-related travel could consider the following adjustments or additions to their benefit plans.

Click here for a larger view of the grid.

Additional Things to Consider when adding a Medical Travel Benefit to your package

- Pretax benefits for medical expenses and travel expenses related to medical care for medical travel services are eligible through a group health plan, such as major medical, HCFSA, HRA, and non-group HSA benefits, if permitted by the plan.

- Commuter and Wellness plans should not reimburse medical expenses. Remember employer reimbursement of medical expenses are still considered a group health plan and should be ERISA-compliant, whether such benefits are considered taxable of not and are subject to additional regulations and laws such as COBRA, HIPAA, ACA PHSA and more.

- Group health plans are subject to ERISA requirements to maintain and operate the plan according to the plan document and provide certain notices to employees and filing IRS form 5500 as well.

- Employers can change coverages either mid-year or at renewal (check with your carrier, Third Party Administrator or stop-loss provider to see what is permitted).

- Employers should define and make clear what services and travel costs are covered. Example: Will travel costs only be eligible for specific related medical expenses, or does the plan include reimbursement of travel for other medical expenses as well? Is the benefit intended only for employees residing in states where certain medical procedures are illegal?

- For Navia HRA and HCFSAs, plan document amendments can be processed up to the end of the plan year for which the change is effective.

- HCFSAs have a statutory annual limit of $2,850 for employee contributions in 2022 (indexed). Employers may fund additional contributions to this benefit in excess of the $2,850 limit. These contributions may be an employer contribution of up to $500, or if an employer would like to fund more than $500, the employer contribution must be a dollar-for-dollar match of employee contributions.

- HRAs are entirely employer funded and most do not have a statutory limits to how much an employer can contribute, but they must be integrated with major medical coverage and eligible only for those enrolled in the major medical coverage, excluding excepted benefit HRA which do not reimburse medical expenses.

- HSAs have a statutory annual limit of $3,650 for self-only and $7,300 for families for 2022 (indexed). There is an additional $1,000 catch up contribution amount for individuals 55 or older.

- For those enrolled in a high deductible health plan (HDHP) the minimum deductible must be met to maintain HSA eligibility before medical or travel expenses can be reimbursed from the HSA.

As states continue to enact laws that make it illegal to assist individuals with related services, employers should consult with their legal counsel to evaluate potential risks associate with offering these benefits to their employees.

Employers will need to continue following local, state, and federal laws and regulations regarding medical travel procedures. Some companies are announcing preemptive action to ensure workers have access to medical services by increasing travel benefits to cover health care procedures. But how these policies interact with state laws may still be unclear, and employers should be aware of the legal risks involved

As further news and guidance becomes available, we will continue to communicate any impact to the benefits we administer, as well as other employee benefit plan considerations.

If you’re interested in adding a medical travel benefit to your plan, please email sales@naviabenefits.com or call 866-831-6133.