Click on any benefit below and download what you need!

Limited Healthcare FSA

Q&A From Webinars

Healthcare FSA

Having already rolled over FSA funds from a previous year can funds be re-rolled over as long as still within limits?

Yes, if your FSA plan includes the carryover feature, you can continue to carryover unspent money in the account from year to year up to the carryover limit (currently $550 for 2021).

What about when my plan is July-June and my husband’s employer offers the same benefits but from January -December. Can each of us enroll in the same benefits such as FSA with max amounts each?

You and your spouse can both participate in an FSA and contribute the maximum amount to both accounts (FSAs are individually held accounts). The only restriction is that you and your spouse cannot both make a claim to your separate FSAs for the same expense (reimburse yourselves twice for the same purchase). You and your spouse can also both enroll in separate HSAs through your companies, but you share a combined annual family contribution limit ($7,100 in 2020, increasing to $7,200 in 2021).

I am working full time still and have health insurance through my employer. Can I legally enroll in a FSA if I have Medicare Part A?

Yes, you can enroll in an FSA if you are a Medicare Part A participant.

Medically necessary is supported with a MDs letter?

Yes, certain health care items and services need a Letter of Medical Necessity (LMN) from a physician or care provider before you can use FSA or HSA funds to cover related expenses. A full list of the items that require an LMN are available in the “Eligible Expense” list under Tools & Resources on the Navia website.

I think I am confused between the FSA and HSA. If I am enrolled in the FSA for healthcare spending, is that the one you mentioned will roll $550 over at the end of the year?

Yes, the healthcare FSA is the plan in which your money must be used each year, and allows up to $550 to be carried over to the next year (if your employer has adopted this feature). HSA accounts do not “expire” and there is no requirement that you spend the money each year (you can accumulate and save HSA funds over multiple years until retirement, similar to a 401k or IRA retirement plan).

Are massages an eligible expense with a Healthcare FSA?

Massages are eligible with a Healthcare FSA if it is deemed as medically necessary.

Do you need a physicians note to be able to use an Healthcare FSA for OTC medications?

No, you no longer need an RX or physician’s note to be able to purchase OTC medications with a Healthcare FSA.

Can I use an FSA with my children even if they are not on my insurance? What about using an FSA with dependents who are NOT tax-dependents?

Your FSA covers your spouse and any eligible dependent children. Children are typically eligible up to age 26.

Does a Healthcare FSA pay for orthodontics or braces?

Yes, orthodontics is an eligible expense. Invisalign is also a covered expense.

Can I join a Healthcare FSA plan after the open enrollment period?

No, you will need to enroll in your FSA during your employer’s open enrollment period. However, if you have a “qualifying event”, such as a change in family status, you can enroll into an FSA.

If you have $500 in your Healthcare FSA to carry over into 2021, does that mean that you can only enroll for a maximum of $2250 in 2021?

No, if you have $500 to carry over into 2021, that amount rolls over and then you can still contribute the maximum of $2750 for 2021. That means your account would have a total of $3250 available for 2021.

Do FSA funds rollover to the next year if not used ?

FSAs can either have a carry over or grace period option. Each plan design is different, so please check with your HR department if your FSA plan has either one of these features.

I delayed several planned medical treatments this year because of COVID-19. Are any deadline extensions/adjustments planned for 2020 plan year?

Nothing has been determined yet for the 2020 plan year.

Is the FSA more or less valuable after the tax code changes done at the end of 2017?

Please check with your tax professional about what works best for you.

Are over the counter meds and feminine products eligible with a Limited FSA?

No, Limited FSAs are restricted to vision and dental expenses, but you can use your HSA to purchase OTC medications and feminine care products. The only exception occurs when you meet your health plan deductible amount during the year, in which case you can start using your Limited HSA for medical as well as dental and vision expenses.

Can a limited purpose FSA be carried over even if an employee changed to a non-HDHP plan in the next plan year?

Yes, if you have funds remaining in a Limited-Purpose FSA at the end of the year and your employer has adopted the carryover feature of FSAs, you may carryover up to $550 of your unspent money to purchase dental and vision items in the next year, even if your employer has changed to a non-HDHP health plan and discontinued an HSA plan.

If I sign up and contribute $500, how is that taken out of my paycheck?

Contributions will be divided equally throughout the year based on your pay period. If you get paid every 2 weeks, you have 26 pay periods a year. The $500 would be divided equally amongst 26 pay periods. With your example, each pay period $19.23 would be deducted from your pay check (before taxes).

If you lose a receipt can you still be reimbursed?

Yes, you will need some sort of documentation to file a claim. An explanation of benefits (EOB) from insurance companies are highly recommended in lieu of a receipt.

Can you make purchases with a personal credit/debit card and then get reimbursed, or can we only use the Navia benefits debit card?

Yes, you can use a personal card to purchase and then seek reimbursement for eligible expenses.

Are orthotic inserts for shoes covered?

Yes, they are an eligible expense.

If I have funds in excess of the maximum carryover amount, can I spend those excess funds in the FSA Store without having a penalty, regardless of a doctors note?

Correct. Participants can use the FSA store to help spend down monies at the end of the year to avoid forfeitures.

Can you increase your deductions in the middle of the year if you find that you have not alloted enough during the beginning of the year?

No, not unless you have a qualified event such as marriage, birth, etc. Once you make an election at OE it is irrevocable.

What’s the mileage reimbursement rate for healthcare appointments?

Mileage reimbursement rates for 2020 are 17 cents per mile as stated on the IRS website.

Is the eligibility for FSA for a full time or part time employees determined by Navia or their employer?

Plan eligibility is determined by employers.

I enrolled in the FSA when I began my new job mid-year. However, I did not switch to my employer sponsored insurance policy until a later date. Am I allowed to use my FSA funds for eligible expenses incurred between the time when I began contributing to the FSA and the time when I enrolled in my (new) employer-sponsored insurance plan?

Your FSA funds can be used during your FSA plan year, regardless of your eligibility on your employer-sponsored health plan. Your FSA is not attached to your health care plan. So if you enrolled June 2020 and your FSA plan ends December 31, 2020, you can use your FSA to pay for eligible expenses from June 2020 to December 31, 2020.

Day Care FSA

For Dependent Care FSA, can those funds carryover into next year?

With Dependent Care FSAs they do not have a carry over option. You may have a grace period, which allows you an additional 2.5 months to spend your Day Care FSA monies. Please check with your HR to see if your Dependent Care FSA plan has the grace period feature.

I read that the original emergency declaration has been extended to January 21st, 2021. As many childcare facilities will be closed through this time, do you anticipate that they will allow employees to enroll in dependent care FSA mid-year?

Disruption or unavailability of day care services during the plan year is known as a “qualifying event”, which means that you can change your Day Care FSA election that you made at the beginning of the plan year. The National Emergency declaration related to COVID-19 does not impact your ability to change your Day Care FSA election due to closures of day care facilities.

What happens within any unused funds in my Day Care FSA?

Depending on your employer’s plan design they may have a grace period feature. For more information about your specific plan features, please contact our customer service or check with your HR department.

Just to confirm, you can only make a contribution for your Day Care FSA during open enrollment or eligible qualifying event. You can’t change it once elected?

That is correct. There are some qualifying events that may allow you to change your original contribution amount. For more information, call/email our customer service or check with your employer.

Can a person use the day care FSA for daytime summer camps for non-disabled kids between ages 12 – 17?

Unfortunately, daytime summer camps are not an eligible expense.

Is there a maximum allowed hourly cost for a baby sitter under day care FSA?

No, there is not a set allowable maximum hourly cost for a baby sitter.

We are legal guardians for our adult daughter. Can she be part of our Day Care FSA plan?

Yes, if she is mentally or physically disabled. You may need to provide documentation to support the claim.

If an employee’s dependent gets braces in December and their FSA card doesn’t begin until January, can they pay for expenses with the FSA after January?

Orthodontics are a covered expense and is the only expense that can be spread over multiple years if the child is in active treatment.

What does substantiation of expenses consist of – Itemized receipt, explanation of benefits, both, or other?

Substantiation of expenses can be both an itemized receipt or an explanation of benefits. The explanation of benefits usually has everything we need to be able to process your claim. Navia is specifically looking for date of service, type of service, service cost, and in some cases provider and patient.

If we pay a grandparent for daycare, do they claim it on their taxes?

You will report to us that you paid your relative for day care services, they would then need to report that money as income. We recommend checking with a tax professional if you have any further questions.

Can I enroll in a Day Care FSA if my spouse enrolls in a Day Care FSA? Does that mean that we can use $10,000 per year?

No, only you or your spouse can enroll and contribute the maximum of $5,000. The Day Care FSA household maximum is $5,000.

While we are in a pandemic, are online camps eligible for the Day Care FSA?

Unfortunately online camps and programs are not eligible as they do not provide “care” to the child.

If a child was sick, therefore not taken to daycare, can a god-parent be reimbursed for providing child care? If so, what is required?

Yes, all you need is for your relative to complete the Day Care Provider Certification section of the claim form that is on our website.

What counts as elder care? Does it have to be for a an assisted living situation or could it be used for in-home care?

For elder care to be eligible under the Day Care FSA, the participant’s parents must be a tax dependent, parent must reside with participant (no assisted living/nursing homes), and expenses must be for care when participant is working. Also, if the nurse/care person is administrating medical needs as well as caring for the patient, that would be considered an eligible expense.

How do I adjust the amount that I’m contributing to my Day Care FSA?

During your open enrollment period you will determine your contribution amount. Mid-year contribution changes are only allow if you have a qualifying event – for example, a change in day care provider, having a new baby, etc. If you need to make adjustments during mid year, please see your HR department for the correct forms. For more information about qualifying events, please contact our customer service department or speak with your HR department.

Commuter Benefits

For the commuter benefit, does this plan needs to come out of payroll or the employee needs to contact Navia directly?

When you place an order for transit or parking benefits under the GoNavia commuter benefit, you tell us how much money you will be spending on transit or parking for the upcoming month. Navia will make that money available to you for use based on your order instructions (on your Navia Benefits Card, on a transit system smart card, or made available for future reimbursement). Your employer will make a pre-tax deduction from one or more upcoming paychecks (depending on your payroll cycles and your employer’s payroll practices) in the amount of your order.

Is gas an eligible commuter benefit?

No, gas purchases are not eligible under a commuter benefits program.

Are Commuter Benefits a pre-tax benefit?

Yes, Commuter Benefits are a pre-tax benefit.

Can commuter benefits be used for anything related to bike commuting?

The federal guidelines for Commuter Benefits has eliminated any bike related commuting as an eligible expense.

Health Savings Accounts

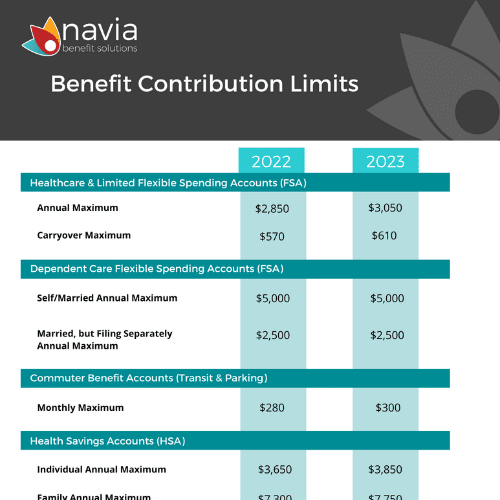

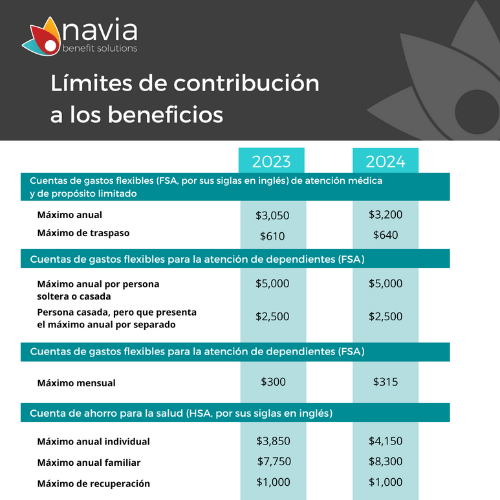

What are the contribution limits for HSAs in 2021?

The contribution limit for HSAs in 2021 is $3,600 for single and $7,200 for family.

What plans are considered as high deductible health plans (HDHP)?

A health plan is considered a high deductible health plan if the minimum deductible limits are $1,400 for single and $2,800 for family. For a HDHP to be eligible for an HSA it must be deemed compatible, also.

So to have an HSA I have to have a HDHP?

You must have an HDHP in order to contribute to an HSA. If you no longer have an HDHP, but still have money in your HSA, you can still use that HSA to pay for eligible healthcare expenses, you just cannot contribute any more money to your HSA.

Is there a way to compare eligible expenses between the HSA and FSA? It would be helpful for deciding which to choose if I could see “oh, the HSA doesn’t cover this but the FSA does” and so on.

All items eligible under a healthcare FSA are also eligible under an HSA and vice versa (the IRS regulation that defines eligible health care expenses under both account types is known as Section 213(d).

Can you have an HSA and a Healthcare FSA?

You can have a HSA and a Limited Purpose FSA, not a Healthcare FSA. A Limited Purpose FSA covers dental and vision expenses only. Your HSA would be used toward your medical expenses.

What is the difference between a HSA and HRA?

A Health Savings Account (HSA) is an account that works with your high deductible healthcare plan (HDHP) where you and/or your employer can contribute money into the account. You can also invest funds with an HSA. A Health Reimbursement Arrangement (HRA) is an account fully funded by your employer to help pay for health care related expenses. You cannot contribute to an HRA. For more information about HSAs or HRAs, please visit www.naviabenefits.com.

If Medicare B is secondary can you have an HSA?

No, if you have Medicare you are not eligible to contribute to a Health Savings Account (HSA). If you already have an HSA then you can still spend the funds toward expenses but you cannot contribute any longer.

If a person is enrolled in a HDHP that person would have to pay $2,800 out of pocket before they can use their HSA money, is that correct?

No, if your medical plan has a $2,800 deductible, you have to pay those costs out of pocket first before your medical plan will pay for your healthcare expenses. You can use your HSA to pay for those $2,800 out of pocket fees.

Prior to Navia, our agency another HSA administrator. Is there any way for me to roll my old HSA balance to Navia? How do I do that?

Yes you can transfer funds from a previous HSA account into your new Navia HSA. To complete the transfer, please download our transfer HSA balance form from your participant portal or speak with your previous HSA administrator to see if they have a preferred way to transfer your balance.

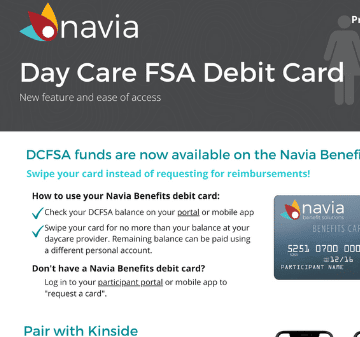

Navia Benefit Debit Card

If I have several different plans with Navia (for example a Healthcare FSA and Day Care FSA) will both accounts be on the same debit card?

Yes, all of your Navia Benefit accounts will be available on your one Navia Benefits debit card.

If traveling overseas and need to purchase OTC medications, can you use the Navia card?

Typically no, unless the store at which you are purchasing items both accepts Mastercard and recognizes the SIGIS/IIAS standard for determining the eligibility of health care items.

If I add a limited FSA to my existing HSA account for which I already have a Navia debit card, will I need a new card in 2021?

No, you will not need a new card in 2021. Your Limited FSA account will automatically be added to your card.

Can I pay for my husband’s prescriptions with my Navia debit card?

Yes, you may purchase your spouse and any eligible dependent’s prescriptions/OTC medications with your Navia debit card.

Will both HSA expenses and limited FSA expenses be accessed with the same Navia debit card? If so, by what mechanism is used to debit the expense from the correct account?

Yes, both benefits will be available on one card. Our proprietary software will be able to determine which expenses will debit the correct account.

Can we use our Navia card to pay for OTC meds or do we need to submit a claim?

You can use your Navia debit card for OTC meds. However in some cases, the store/pharmacy you purchase them from may not have updated their terminals yet with this new update by the IRS. If that happens, you will need to submit a claim for reimbursement.

Do I need to purchase eligible items at a pharmacy, or checkout at the pharmacy register, so that I can use my Navia debit card for those items?

No. Many retail stores other than pharmacies recognize the eligibility of health care items (large grocery chains, WalMart, etc.). If the store or chain recognizes eligible health care items (technically, by being a SIGIS IIAS certified merchant), then you can use your Navia card at any checkout register to purchase over-the-counter medications and other eligible items.

Can my spouse use my Navia Card for co-pays or do they need to have their own card?

Your spouse or dependent can use your card, however, we suggest that they get their own card for ease of use. You can get an additional card with their name on it through the participant portal or mobile app.

If I buy something that costs more than my balance on my Navia card, will the purchase be denied or can I pay the balance out of my own pocket?

Some stores will be able to accept a partial payment from your Navia Benefits debit card, other stores may not. It is dependent upon their POS system.

My spouse is on my insurance plan and if both of us contributes an FSA. In this case, do we each get a Navia Benefits debit card?

Each employee would have their own account and their own debit card, even if you both work for the same employer. If your spouse works for a different employer then he/she would need to check with their HR department on the availability of a card.

How do I get a PIN to run the card as debit?

A pin is not needed to use our card. However, you can request a PIN number from Navia in situations where the provider’s POS machine requires it.

How long does it take for a debit card swipe to show up on your account?

The authorization happens immediately, and then it takes about 48 hours to show up in your history.

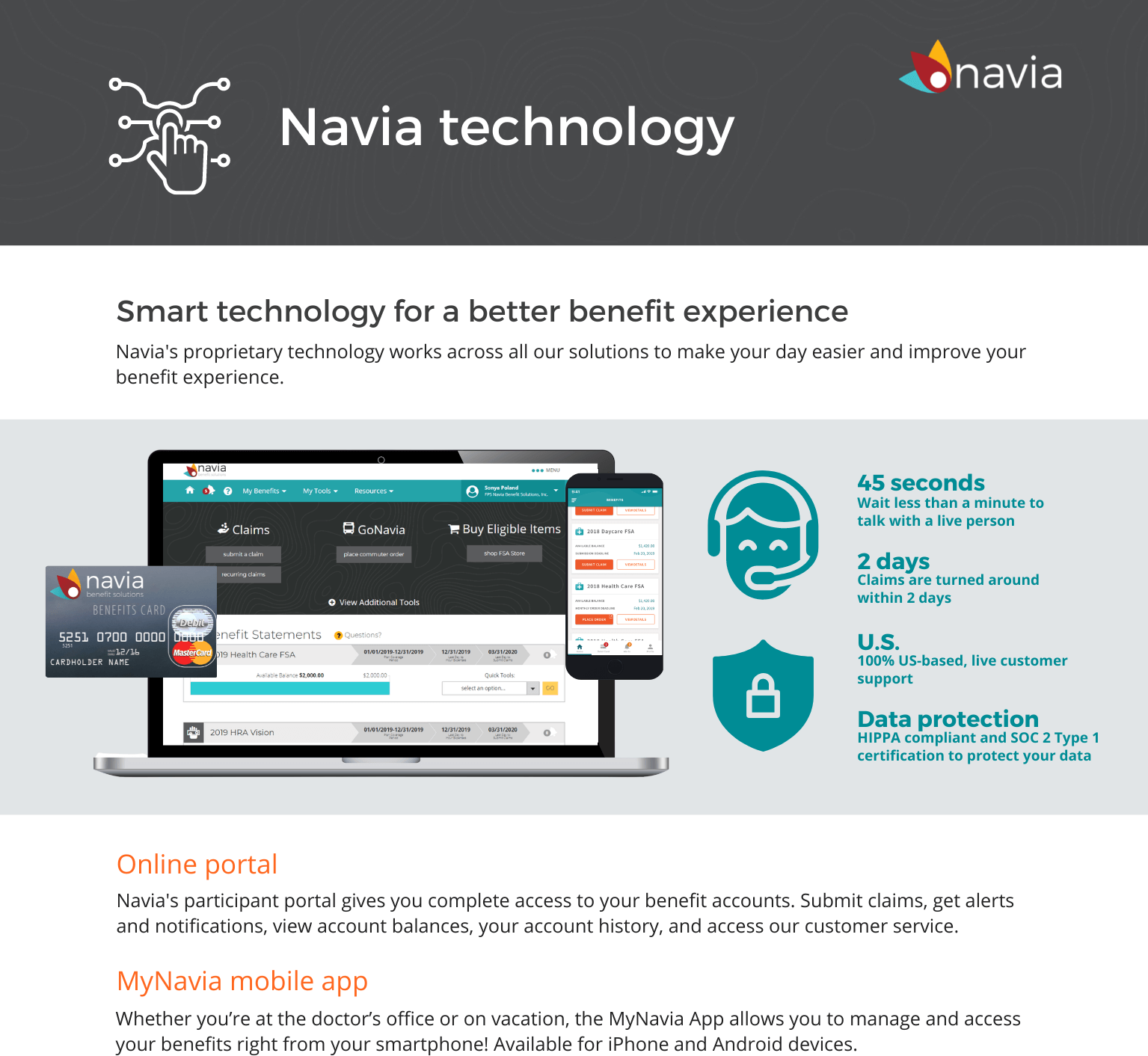

Participant Portal/Mobile App

Do you need to submit claims when the Navia portal/app already shows that a debit card swipe is approved when you haven’t submitted a receipt?

You will only need to send us a receipt on a debit card swipe if we reach out and ask for it.

COVID-19 & It’s affect on benefit plans

I heard that because of COVID, deduction elections can be altered outside of Open Enrollment. Would this be adjusted through our HR Departments?

Employer groups would need to have adopted a mid-year change amendment in order to change the FSA during the year. Dependent care is a bit more flexible and changes can be made if day care providers change or close etc. Any election changes would need to be made through your HR department.