The EBSA Disaster Relief Notice and the American Rescue Plan Act (ARPA) brought 100% COBRA subsidies, an increase in the Dependent Care FSA maximum from $5,000 to $10,500, and a new timeline for benefit extensions.

On February 26, 2021, the Department of Labor (DOL) issued the EBSA Disaster Relief Notice 2021-01 revised guidelines related to the deadlines for Flexible Spending Account (FSA), Health Reimbursement Arrangement (HRA), and COBRA plans. These guidelines change the original extended deadlines that were announced in May 2020 as a result of the National Emergency. Instead of waiting for the National Emergency to end, the new deadlines for FSA/HRA allow a one-year extension from the plan run out date and COBRA allows qualified beneficiaries a one year extension on elections from their original COBRA offer.

On March 11, 2021, the federal government passed and signed ARPA into law in hopes of speeding up the United States’ recovery from the economic and health effects of the COVID-19 pandemic and the ongoing recession. The additional support comes in the form of 100% COBRA subsidies and an increase in the Dependent Care FSA maximum. A copy of the executed legislation can be found here: https://www.congress.gov/bill/117th-congress/house-bill/1319/text

We unpack all these changes in detail below.

Dependent Care FSA Increase

ARPA temporarily increased the Dependent Care FSA contribution maximum amount that can be excluded from income from $5,000 to $10,500 for the 2021 calendar year. Employers with a Dependent Care FSA will need to adopt an amendment for the 2021 calendar year to provide this increased amount. Retroactive amendments are permissible if the amendment is adopted on or before the last day of the plan year.

Employers adopting this increased maximum may allow their employees to increase their dependent care election mid-year. This allowance is due to the change in status flexibility provided under the Consolidated Appropriations Act, 2021 (CAA, 2021) and further clarified under IRS Notice 2021-15 for plan years ending in 2021. However, employers who have not adopted that flexibility may still allow employees to increase their elections under 26 CFR § 1.125-4, the change in status regulations, provided that the increased maximum qualifies as a significant improvement of a benefit package.

The maximum contribution increase changes may affect nondiscrimination testing (NDT), particularly the 55% dependent care average benefits test. Please check with your administrator for information about this issue and how it will affect your NDT. For Navia clients, we are making some enhancements to our NDT portal, and employers may begin pretesting their day care benefit after April 1, 2021. To access the online tool, select the Nondiscrimination Testing Link in the Resources Section of the portal to submit your pretest.

Finally, for those plans that straddle tax years, employers may need to permit employees to reduce their salary reductions by December 31, 2021, to ensure employees do not exceed the maximum in the subsequent tax year. Depending on timing this change could be permitted based again on the change in status flexibility under IRS Notice 2021-15 or existing change in status rules governing significant curtailment of coverage.

100% COBRA Subsidies

Among the relief provisions included in ARPA is 100% COBRA subsidies for premiums for those who experienced a loss of coverage due to involuntary termination or reduction in hours.

The COBRA subsidies will cover 100% of premium payments between April 1, 2021 and September 30, 2021. To be eligible for the COBRA subsidies, qualified beneficiaries must be within the period of COBRA eligibility from their original notice, and they must have lost their employment involuntarily or had a reduction in hours. If they left their job voluntarily they are not eligible for the subsidy.

The COBRA subsidies will pay the premium costs for group health plans, medical/dental/vision/EAP plans, and most other forms of insured health coverage. Continuation of FSAs, standalone vision/dental HRAs, and other account-based forms of health coverage are not covered by the subsidy. If premium payments for non-subsidized plans are not received timely you could experience a service interruption in all COBRA benefits.

If qualified beneficiaries had COBRA coverage that lapsed or if they deferred their decision to elect but are still in the 12-month window of COBRA eligibility outlined in the COBRA Election and Premium Payments section above, they can elect COBRA coverage effective April 1, 2021 and be eligible for the subsidy. They do not need to pay premiums for the months that their coverage lapsed to receive the subsidy. They must mail or email their original enrollment form or contact us to process a COBRA enrollment.

If they are eligible for other group health plans (including Medicare) they are not eligible for the subsidy. If at any time that they are enrolled and receiving the COBRA subsidy and they become eligible for other forms of health coverage (including Medicare) they must notify us to terminate the subsidy. The penalty for failing to discontinue their COBRA coverage while eligible for other coverage is either $250 or 110% of the amount of the subsidy, whichever is greater.

New benefit extensions from the EBSA Disaster Relief Notice

As mentioned earlier, the EBSA Disaster Relief Notice revised guidelines related to the deadlines for FSA, HRA, and COBRA plans. These guidelines change the original extended deadlines that were announced in May 2020 as a result of the National Emergency. We will break down the guidelines into the follow categories:

- FSA & HRA

- COBRA

FSA & HRA Guidelines

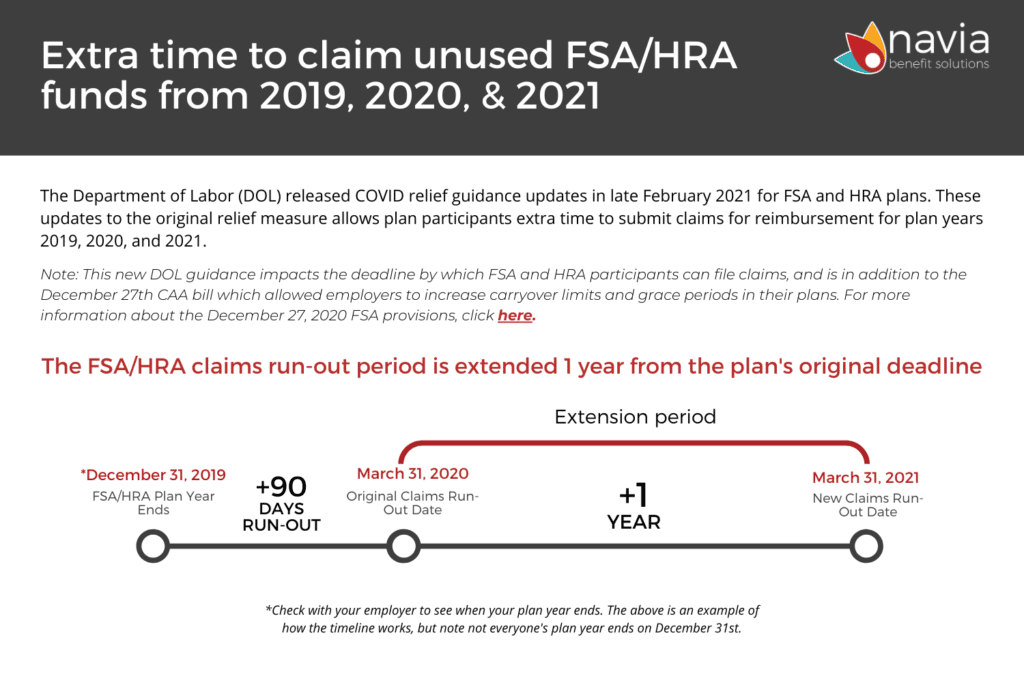

The updates made by the EBSA allow additional time to submit claims for reimbursement from participant’s 2019, 2020, and 2021 FSA or HRA plan years. Our timeline below shows how the deadline extensions work. Click here to download the timeline.

This DOL guidance impacts the deadline by which FSA and HRA participants can file claims, and is in addition to the December 27th CAA bill which allowed employers to increase carryover limits and grace periods in their plans. For more information about the December 27, 2020 FSA provisions, click here.

If you are a Navia FSA/HRA participant, submitting a claim for reimbursement is easy! Gather your receipts for any eligible expenses, log into your participant portal, submit your claim, and receive your reimbursement within a few days.

COBRA Guidelines

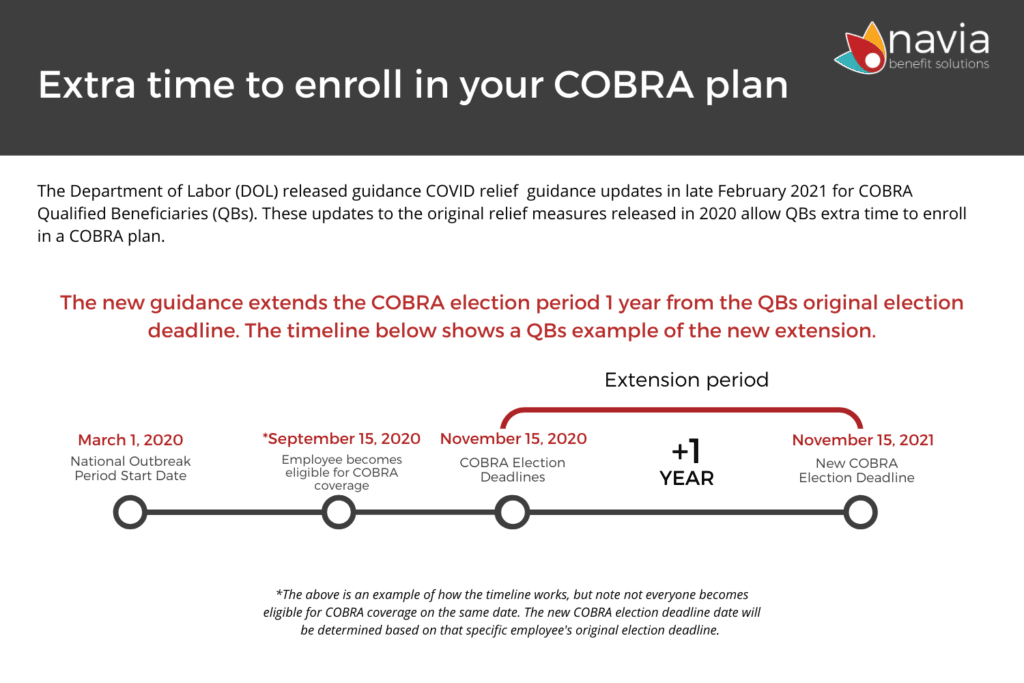

COBRA plans received two important changes through the EBSA Disaster Relief Notice – New Election Deadline and New Premium Payment Deadline. Below we go through each updated guidance.

COBRA Election Deadlines

As show in the above graphic, if a COBRA qualified beneficiary’s election deadline was March 1st, 2020 or later, they now have one (1) year from the original election deadline printed in your COBRA rights notification letter to elect health coverage under their former employer’s COBRA plan. Click here to download the above timeline.

When the COVID National Emergency and Outbreak Period is declared over, qualified beneficiaries will have until either one (1) year from their original deadline or the date that the National Emergency is declared over plus 60 days to make your election, whichever is earlier. There is currently no estimated date for when the National Emergency will end.

- Example: if a qualified beneficiary became eligible for COBRA and received their notification letter in June of 2020 with an election deadline of July 31, 2020, they now have until July 31, 2021 to elect to continue coverage. Likewise, if the COVID National Emergency later this year is declared over with an end date of September 15th, they will have the shorter of either (1) year after your original election deadline or November 14thto make their enrollment decision (September 15th + 60 days).

COBRA Premium Payment Deadlines

Under normal circumstances, COBRA participants have 45 days from the date in which they elected COBRA to make their initial premium payment. They now have one year beyond that 45-day deadline to make their first payment.

Normally, monthly premiums are due on the first of the month with a 30-day grace period. With the extended guidelines COBRA participants now have one year plus the 30-day grace period to pay for each month of coverage. They can pay one month of premiums at a time as long as the one-year deadline is met.

If they miss any of these updated extended deadlines for enrollment or premium payments, their COBRA coverage will lapse and cannot be reinstated.

Have more questions about how COVID is impacting your benefits?

Check out our COVID Resource page! Navia has compiled a comprehensive library of resources to help you navigate benefit changes during the COVID-19 pandemic. Learn about all the stimulus bills and CARES ACT changes, download plan amendments, get resources for participants, and much more! We update this site regularly in accordance to the latest updates and change.