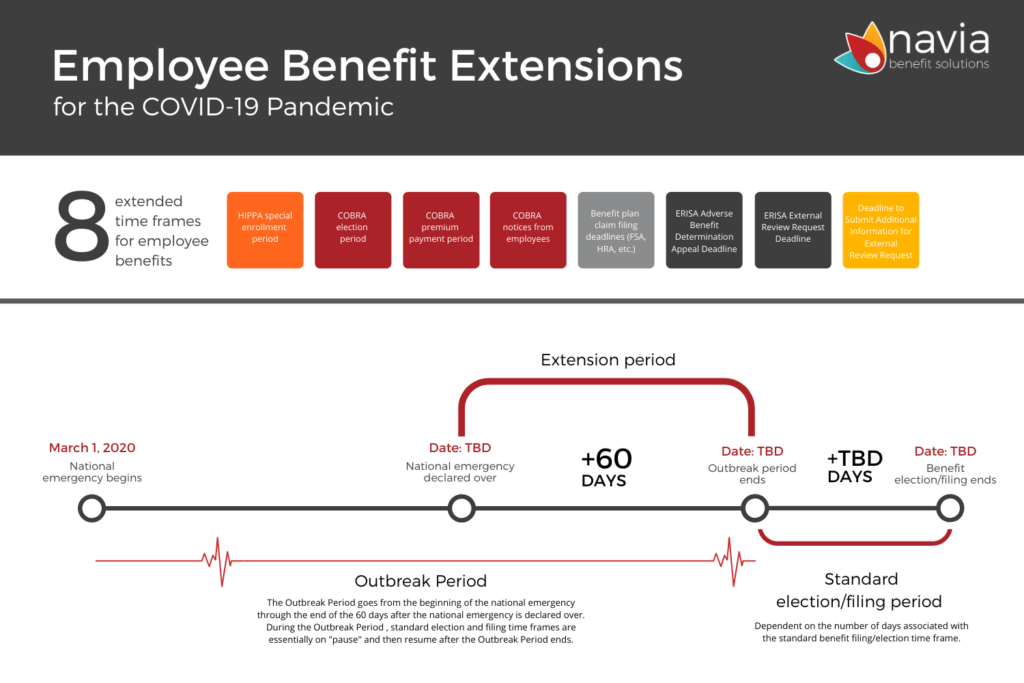

Understand the 8 employee benefit extensions designed to help employees and COBRA beneficiaries during the COVID-19 pandemic

(Download the Ultimate Guide to Managing Benefits During COVID-19)

On April 29, 2020, the Department of Labor, Revenue, and Treasury (the “Departments”) issued benefit extensions for certain group health plans, disability and other welfare plans, and pension plans during the COVID-19 National Emergency.

The goal of the benefit extensions is to minimize the possibility of individuals losing benefits because of a failure to comply with an applicable timeframe.

There are eight benefit timeframes that have been extended. We go into detail about each one below and provide examples to illustrate how the benefit extensions will work. You can also download our benefit extensions infographic for a snapshot of the extensions and new timeframes.

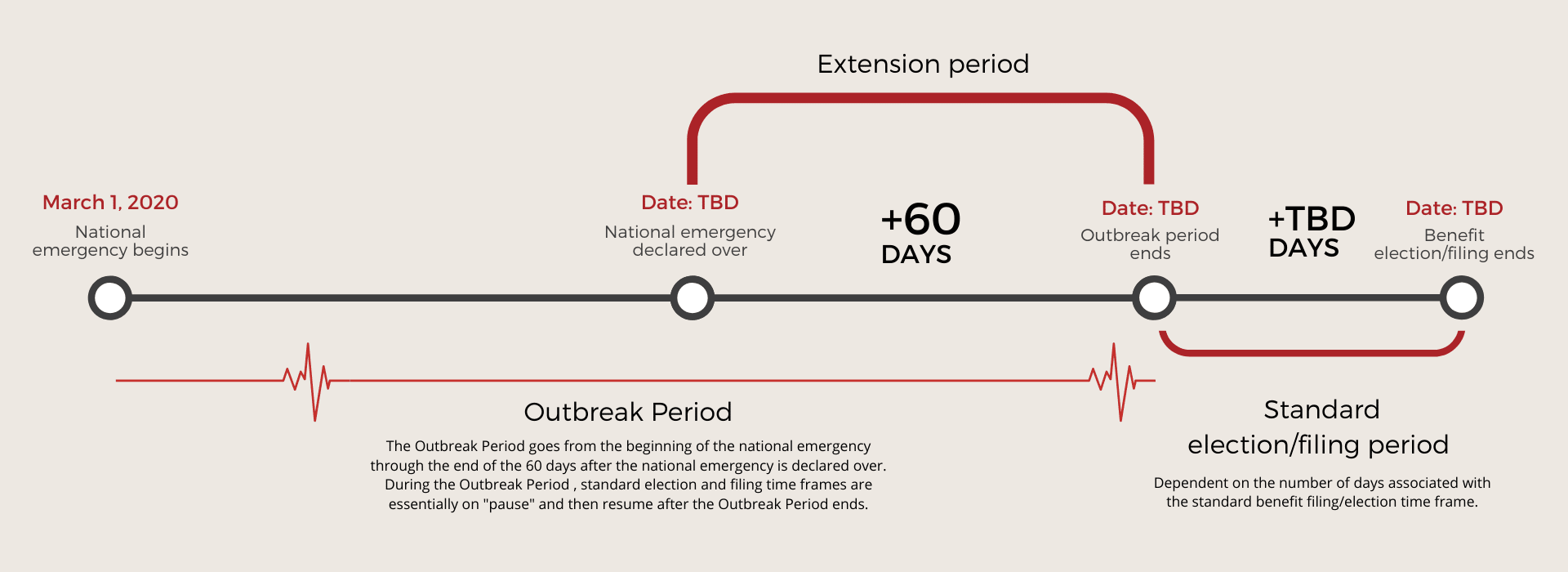

Outbreak Period

The term “Outbreak Period” is used to define the period of time affected by the extensions.

- The Outbreak Period started on March 1, 2020 when President Trump declared a National Emergency in response to COVID-19.

- The Outbreak Period will end 60 days AFTER the National Emergency is declared over.

- For example, the National Emergency became effective March 1, 2020 and if President Trump announces on May 31, 2020 that the National Emergency is over, the Outbreak Period will be March 1 to July 31, 2020 (National Emergency timeline plus 60 days).

The Outbreak Period goes from the beginning of the national emergency through the end of the 60 days after the national emergency is declared over. During the Outbreak Period , standard election and filing time frames are essentially on “pause” and then resume after the Outbreak Period ends.

Timeframe Extensions Disregard the “Outbreak Period”

On March 13, 2020, President Trump issued the Proclamation on Declaring a National Emergency Concerning the Novel Coronavirus Disease (COVID-19) Outbreak and by separate letter declared a national emergency under the Stafford Act effective March 1, 2020.

As a result of the National Emergency, the Departments recognized that participants and beneficiaries covered by group health plans, disability or other employee welfare benefit plans, and employee pension plans may find it difficult to meet or comply with certain pre-established timeframes. Similarly, the Departments recognized that group health plans may have difficulty in complying with certain notice obligations.

Essentially, this guidance requires benefit plans to disregard the period from March 1, 2020 until sixty (60) days after the announced end of the National Emergency, or such other date announced by the Agencies in a future notice (the “Outbreak Period”). To the extent there are different Outbreak Period end dates for different parts of the country, the Departments will issue additional guidance.

8 New Benefit Extensions and How they Work

Please note the date used in the examples for the “end of the national emergency” is just an example date to help illustrate how the extension timeframes work. We do not yet know when the end of the emergency will be declared.

(1) HIPAA special enrollment period

Generally, group health plans (GHPs) must allow individuals to enroll in the GHP if enrollment is requested within 30 days of the occurrence of the event (or within 60 days, in the case of the special enrollment rights added by the Children’s Health Insurance Program Re-authorization Act of 2009).

Example: Assume the end of the national emergency is April 30, 2020. During open enrollment, Randy declines coverage in his employer’s GHP. On March 31, 2020, Randy’s wife gives birth. Randy would like to enroll himself, his wife, and his child in his employer’s plan. Open enrollment does not begin until November 15, 2020. Since the timeframe beginning March 1, 2020, through the Outbreak period is disregarded, Randy now has until July 29, 2020, to enroll, provided that he pays the premiums for any period of coverage. Practical Point: If Randy waits until July 29, 2020, to exercise his special enrollment rights, neither the employer or the carrier would know to provide coverage to Randy and his family until his election is made.

(2) COBRA Election Period

COBRA generally provides a qualified beneficiary 60 days to elect COBRA continuation coverage under a group health plan.

Example: Assume the end of the Outbreak Period is June 30, 2020. Sandy is terminated on February 25, 2020. Sandy’s specific rights notice is mailed on March 1, 2020. Sandy’s 60-day COBRA election period would end on April 29, 2020 but since the timeframe beginning March 1, 2020, through the Outbreak Period is disregarded, Sandy has until August 29, 2020 to elect COBRA.

<<Need help managing COBRA? Learn how Navia can help>>

(3) COBRA Premium Payments

COBRA continuation coverage may be terminated for failure to pay premiums timely. A premium is considered timely paid if it is made not later than 30 days after the first day of the coverage period.

Example: Assume the end of the Outbreak Period is July 31, 2020. Jim is enrolled and making timely payments on COBRA as of March 31, 2020. He does not make April’s premium payment within the 30-day payment grace period. Because the 30-day grace period is disregarded through the Outbreak Period, Jim has until August 30, 2020 to make April, May, June, July, and August’s premium payments.

(4) COBRA Notices – Qualifying Event

Notice requirements prescribe time periods for individuals to notify the plan of certain qualifying events or a determination of disability. Notice requirements also prescribe the time period for employers to notify the plan of certain qualifying events.

Example: Assume the end of the Outbreak Period is September 30, 2020. Bob is enrolled in COBRA with his spouse Tricia. Bob and Tricia divorce on April 1, 2020. Bob has the obligation to notify the plan sponsor/administrator of the divorce within 60 days which will trigger a dependent level COBRA offer for Tricia. Because the 60-day notice requirement is disregarded through the Outbreak Period, Bob has until November 29, 2020 to notify the plan sponsor/administrator of the divorce.

(5) Benefit Plan Claims Filing Procedure Timeframe (FSA/HRA)

The date within which individuals must file a claim under the plan’s claims procedures.

Example: Employer, Teresa Co., provides her employees an FSA benefit. Teresa Co.’s plan runs January through December with a ninety-day claims run-out period ending March 31, 2020. The national emergency is effective March 1, 2020. In this example assume the national emergency ends May 31, 2020. As of March 1, 2020, Teresa Co’s participants had 30 days until the claims run-out deadline—due to the guidance, that timeframe is disregarded until the end of the national emergency plus 60 days. Therefore, plan participants new claims run-out deadline is August 29, 2020. August 29, 2020, is reached by assuming May 31, 2020, is end of the national emergency, plus 60 days, plus the 30 days disregarded from March to March 31st.

(6) ERISA Adverse Benefit Determination Appeals Deadlines

The date within which claimants may file an appeal of an adverse benefit determination under the plan’s claims procedure.

FSA Example 1: Assume the end of the national emergency is May 31, 2020. Tim, an FSA participant, receives a denial of his FSA claim on March 15, 2020. Tim normally has 180 days from March 15, 2020, to file an appeal. Since the timeframe beginning March 1, 2020, through the Outbreak period is disregarded, Tim now has until January 26, 2021 to file his appeal. In this example the January 26, 2021, is determined by assuming the end of the national emergency is May 31, 2020. Add sixty more days to get to July 30, 2020 (the outbreak period) plus the 180 days to appeal.

HRA Example: Assume the end of the national emergency is April 30, 2020. Bob, an HRA participant, receives a denial of his HRA claim on January 28, 2020. Bob normally has 180 days from January 28, 2020, to appeal his denial. Since the timeframe beginning March 1, 2020, through the Outbreak period is disregarded, Bob now has until November 24, 2020, to file his appeal. In this example November 24, 2020, is determined by assuming the end of the national emergency is April 30, 2020, plus sixty days, plus 148 days (180 – 32 days following January 28 to March 1st).

(7) ERISA External Review

The date within which claimants may file a request for an external review after receipt of an adverse benefit determination or final internal adverse benefit determination.

Example: Assume the national emergency ends April 30, 2020. Megan receives a denial on March 15, 2020. Normally, Megan has four months from March 15, 2020, to file a request for external review. Since the timeframe beginning March 1, 2020, through the Outbreak period is disregarded, Megan now has until October 29, 2020, to file her request. In this example October 29, 2020, is determined by assuming the end of the national emergency is April 30, 2020, plus sixty days, plus four months.

(8) Deadline to Submit Additional Information for External Review

The date within which a claimant may file information to perfect a request for external review upon a finding that the request was not complete.

Example: Assume the national emergency ends April 30, 2020. Natalie receives notice of an incomplete external review request on March 15, 2020. Normally, Natalie has four months from March 15, 2020 to perfect her request. Since the timeframe beginning March 1, 2020, through the Outbreak period is disregarded, Natalie has until October 29, 2020, to perfect her request. In this example October 29, 2020, is determined by assuming the end of the national emergency is April 30, 2020, plus sixty days, plus four months.

Navia’s commitment to providing high-quality service has never been more important and we will continue to find ways to help during these difficult times. Please check back regularly for updates. Stay safe and healthy.

<<Get help managing your COBRA services. Learn more here>>