FAQs about managing benefits during the COVID-19 pandemic

**UPDATED ON 9/17/2020 w/ updated carryover information**

(Download the Ultimate Guide to Managing Benefits During COVID-19)

As our situation changes daily, Navia is committed to bringing you the latest information about managing your benefits during the COVID-19 crisis. We will be updating this post often as we get new information and expand our FAQs to respond to your most frequently asked questions. To help you find answers fast, we have categorized our responses by the following main subjects:

FAQ Table of Contents

- Helpful Terms

- General guidelines for employees on leave/furlough/change in benefits eligibility status

- Health Care Flexible Spending Accounts

- Daycare Flexible Spending Accounts

- Health Savings Accounts

- COBRA

- Commuter Benefits

- Health Reimbursement Arrangements

Helpful terms

What is the National Emergency?

A Federal National Emergency was declared by the Trump Administration on March 1st in response to the COVID-19 pandemic. In general, the declaration of the National Emergency enables federal and state governments to offer benefits and relief to people directly suffering from the effects of COVID-19, in addition to relief measures for companies and employees who are suffering financially from the crisis. Employee benefits and health coverage are a few of many areas that have received some form of financial or compliance relief under the National Emergency.

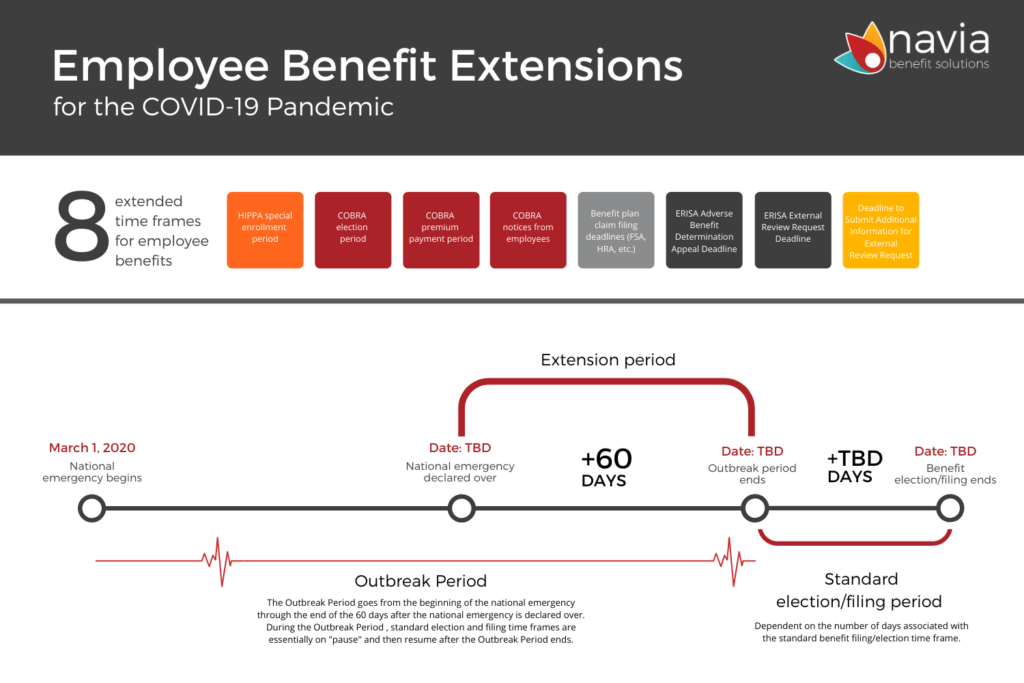

What is the “Outbreak Period”?

The Outbreak Period is a term created in guidance by the Department of Labor (DOL) in late April, 2020, and is defined as the timeframe between March 1, 2020, and 60 days after the National Emergency is declared over. As an example, if the National Emergency is declared over on May 31st, 2020, then the Outbreak Period would be the period from March 1st, 2020 through July 30th, 2020.

Why is the Outbreak Period important to COBRA and other benefits with claims or filing deadlines?

The April guidance from DOL suspended various deadlines during the Outbreak Period for COBRA participants and for certain employee benefit plans (primarily FSAs and HRAs) that typically have claim deadlines and run-out periods. During the Outbreak Period, the “clock is off” for the typical deadlines in these benefits, and will not be enforced until the Outbreak Period is over.

<<return to table of contents>>

General guidelines for employees on leave/furlough/change in benefits eligibility status

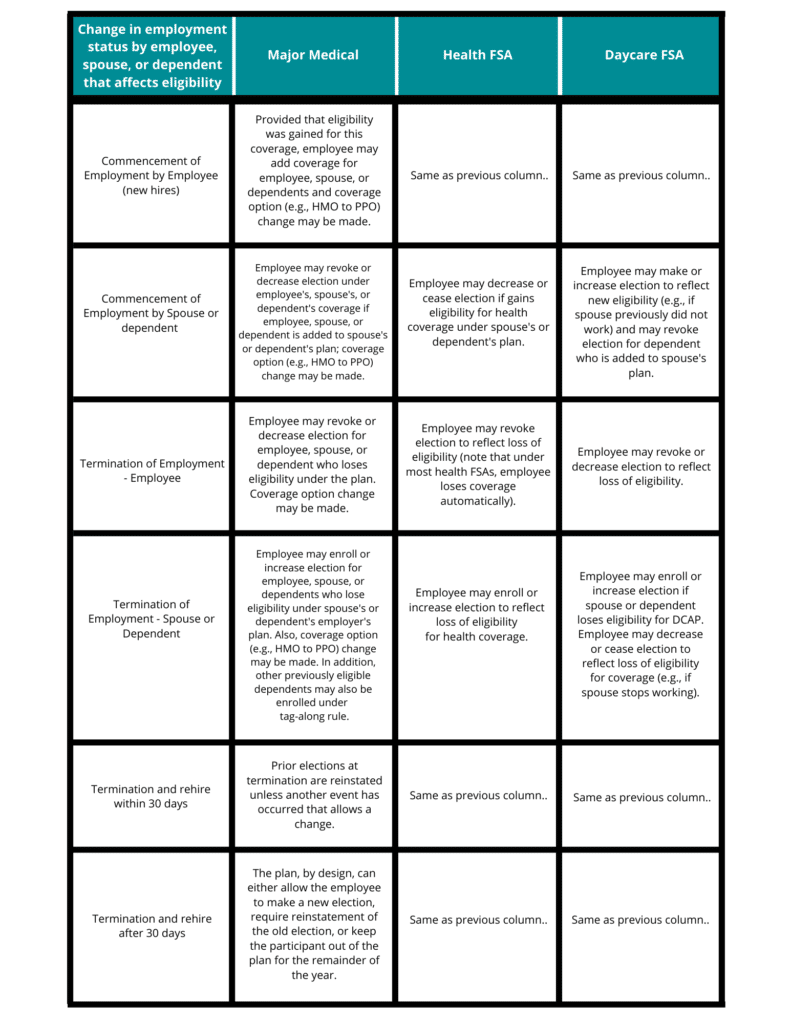

My company is doing everything it can to keep our employees on payroll and eligible for benefits. We are reviewing all employment status contingencies at this time, including paid leave under the Family Medical Leave Act (FMLA), reductions in hours and/or rate of pay, short-term unpaid leave, and/or permanent layoffs. How do these situations affect eligibility and continuation of health and FSA benefits?

See the following responses and table below for a listing of various employment status change events, along with relevant considerations and recommendations related to health plan and FSA coverage.

What changes are introduced by the Families First Coronavirus Response Act (FFRCA) relative to emergency paid sick leave (EPSL) and expanded family and medical leave (expanded FMLA)?

The FFRCA includes reimbursement in the form of tax credits to companies with fewer than 500 employees to pay for expanded sick and family leave, effective April 1, 2020 through December 31, 2020. A brief summary of the FFRCA provisions for employees of companies under the Act are as follows:

- Up to 80 hours of paid sick leave at the employee’s regular pay rate for those employees unable to work because they are directly affected by or under quarantine because of the COVID-19 virus.

- Up to 80 hours of paid sick leave at 2/3 of the employee’s regular pay rate for those employees unable to work because they are caring for a family member or dependent impacted by COVID-19, or because they are caring for a child under age 18 whose school or day care facility is closed.

- Up to 10 additional weeks of paid expanded family and medical leave (under FMLA) at 2/3 of the of employee’s regular pay rate for those employees unable to work because they are caring for a child under age 18 whose school or day care facility is closed.

For a further details, additional FAQs, and template communications related to the FFRCA, please see the Department of Labor site at https://www.dol.gov/agencies/whd/pandemic. Information, FAQs, and forms for employers seeking the available tax credits for reimbursement of costs associated with the EPLS and expanded FMLA provisions should visit the IRS site at https://www.irs.gov/newsroom/covid-19-related-tax-credits-for-required-paid-leave-provided-by-small-and-midsize-businesses-faqs.

For employees going on leave under the Family Medical Leave Act (FMLA) provisions, are there other considerations that I should communicate?

Employees impacted by COVID-19 themselves, or those who need to be home to take care of an immediate family member may wish to go on a leave of absence (LOA). Under FMLA, employees can choose to revoke or continue group health plan and health FSA coverage during an unpaid leave. Employers can also require that coverage continues during an unpaid leave but allow the employee to temporarily discontinue their contribution to premium costs. If the employer continues coverage during an unpaid leave, the employer may recover the employee’s share of premiums after they return to work.

If possible, employers should determine whether the employee will revoke or continue group health and FSA coverage during leave. If they choose to continue coverage, expenses incurred during leave are eligible. The IRS regulations provide three options for funding the benefit in the event an employee chooses to continue coverage:

- accelerate contributions out of the last paycheck before leave begins

- pay-as-they-go using after-tax dollars

- catch-up payments upon return

If the employee revokes FSA coverage, expenses incurred during the LOA are not eligible for reimbursement. Upon return from leave, the employee may resume their original per paycheck deduction (thereby decreasing their annual election by the amount of the missed contributions).

For employees returning to work from an FMLA leave, how do I calculate their new deduction amounts (“catch-up contributions”) to make up their missed contributions while they were on leave?

To calculate an employee’s catch-up contributions to make up the missed contributions while on leave, the formula is:

- (Annual Election – Total Contributions prior to the Leave)

- (Number of Remaining Pay Periods in the Year)

As an example, an employee with $2000 election in their health care FSA goes on leave on April, 1st, 2020, and has contributed $500 to date. They are paid semi-monthly, and they return to work on July 1, 2020. The calculation for their catch-up contribution from their remaining paychecks would be:

- (2000 – 500) / (12 remaining pay periods) = $125

What about employees going on unpaid leave outside of FMLA provisions?

In general, no election changes can be permitted for an unpaid leave unless the employee who goes on leave loses eligibility for coverage. Employers that would like employees to be able to drop coverage during unpaid leave must amend their documents to state that those going on unpaid leave are not eligible for benefits. Some employers will borrow FMLA rules and apply those to unpaid leave. Employers will need to consult their plan documents or related polices regarding unpaid leave and amend those as they see necessary.

What about employees who are being furloughed?

Furlough, unless otherwise described in your plan documents, is essentially the same as a layoff but with the expectation that the employees have an expectation that they could return. Furlough is generally not a change in status unless the furlough triggers eligibility as stated in your plan document. In most cases, furloughed employees are eligible for COBRA, unless your plan documents explicitly states that furloughs will not trigger a change in benefits eligibility.

If you want to provide free or subsidized coverage to furloughed employees and your plan is fully insured or you have purchased stop-loss insurance, we recommend employers consult with the carrier before amending your plan to provide such coverage.

What about employees who will be working reduced hours?

A reduction in hours may allow coverage to be revoked prospectively under group health plans, but not health care FSAs unless a reduction in hours triggers a change in eligibility. Employees working reduced hours can change or stop their health care FSA elections if the reduction results in a change in eligibility as defined in your health plan or flexible benefits plan documents. Employees whose hours of service are reduced below 30 hours per week as a result of a change in employment status can drop employer-sponsored health coverage (even if eligibility for the coverage is not affected) if the participant intends to enroll in another plan offering minimum essential coverage and other specific conditions are met. These rules apply to variable hour employees and is beyond the scope of this FAQ. If employers have variable hour employees they will need to review the rules regarding reduction of hours and permissible changes.

What about employees who will be working with a reduction in their pay?

Reduction in pay are typically not considered qualified status change events unless specifically defined in your plan document. If pay reduction causes the employee to become newly eligible for a subsidy under the Affordable Care Act, the employee may be able to enroll for health coverage through an ACA exchange. We are seeing employers weigh the benefits of reducing the cash flow burden on employees who are experiencing hardships against any compliance risks during this time of unprecedented emergency. Employers should consult with their legal counsel and/or employment advisors for guidance in these circumstances.

Our medical plan carrier is allowing a special midyear enrollment period for non-new hires to join the plan. Do cafeteria plan rules allow this?

Change in status rules do allow midyear enrollment/changes to be made if there are significant changes to a plans cost or coverage. Without a change to cost or coverage that is deemed “significant”, current regulations do not permit someone to enter the plan midyear and have those premiums deducted pre-tax through payroll. Midyear enrollment may be permitted, but without a qualifying event to allow the change, premium deductions would need to be made on post-tax basis.

Can I take FSA deductions for employees using vacation/sick time while on leave?

Yes, as most employees using paid vacation and sick time are still fully employed and compensated under your PTO/sick policies and are not triggering a change in eligibility.

Health Care Flexible Spending Accounts

The recent DOL guidelines suspended the claims run-out periods for plans with a run-out in effect as of 3/1/2020. What will happen to forfeiture in these plans?

Forfeiture calculations for 2019 FSA and HRA plans will obviously be delayed because of the extended filing periods for claims. The actual date by which forfeitures will be calculated is uncertain until the federal government declares an end to the National Emergency and the exact length of the Outbreak Period will be known. Navia will promptly calculate FSA and HRA plan forfeiture amounts following the end of the Outbreak Period and will be communicating to employers accordingly.

Do I need to amend my FSA or HRA plan documents because of the suspension of the claims filing period?

Because the DOL guidance does not represent a meaningful change in benefits or costs in the plans, Navia’s general recommendation is that no plan document changes are required. If you or your compliance team have a common practice of documenting all changes to your benefit plans, you may download and complete our plan amendment template here. You can keep the completed amendment for your files, and you do not need to return a copy to Navia.

I have heard about the new eligibility provisions for over-the-counter (OTC) products as a function of the CARES Act passed on March 27th. What’s new, and do I need to do anything to my plan document to adopt them?

The CARES Act expands and broadens the use of FSAs/HSAs/HRAs for certain types of healthcare products and services, including:

- The inclusion of additional over-the-counter (OTC) items as qualified medical expenses, specifically menstrual care products. This change affects any purchases made after December 31, 2019 and is a permanent change to the list of eligible expense items that can be purchased with FSA/HSA/HRA funds.

- Relaxation of the rules related to purchases of over-the-counter (OTC) medications, so that FSA/HSA/HRA funds can be used to purchase cold medications, antihistamines, antacids, anti-inflammatories, and other health-related items without requiring a prescription. The CARES act essentially reverses the impact of the 2010 Affordable Care Act provisions which restricted the use of FSAs and HSAs to the purchase of prescription medications.

The new OTC provisions of the CARES Act are effective as of January 1st, 2020 and require no action on the part of employers, unless your FSA/HSA/HRA plan documents include specific language that excludes OTC items or requires a prescription for OTC purchases (this is a rare exception, as most plan documents allow expenses under Section 213(d) of the tax code which has been broadened and amended by the CARES Act). Navia has created a general advisory to employers to assist the review of their plan documents (download here), plus a template plan amendment to include the newly-eligible OTC items into your plan if they are currently excluded (download here).

Our company’s FSA claims run-out period for our 2019 FSA plan ended on 3/31/2020. I would like to extend it to give my employees more time to file claims…can I do this and how?

On April 29, 2020, the Department of Labor released additional guidance related to the COVID-19 pandemic that extended the deadlines associated with many benefit plans subject to ERISA and HIPAA guidelines. Under the guidance, FSA claim filing deadlines were suspended as of the declaration of the National Emergency on March 1, 2020. FSA participants can continue to file claims for eligible medical expenses incurred in 2019 until 60 days after National Emergency is declared over.

In addition, some employers took action in March, 2020 to extend their FSA plan run-out period beyond March 31, 2020. The new DOL guidelines also apply to these plan amendments and allow FSA participants to file 2019 claims until 60 days after the declared end of the National Emergency. Participants should contact Navia Customer Service at customerservice@naviabenefits.com if they need assistance filing claims under the new guidelines.

Our company’s FSA grace period just ended on 3/15/2020. Can I extend this so that employees can incur new medical expenses and file under our 2019 plan year?

No, currently under published IRS guidelines, the FSA grace period is a defined and fixed period of 2 ½ months following the close of the plan year. The IRS has not provided any additional guidance or changes to this policy since the onset of the COVID-19 crisis, but Navia is monitoring all regulatory updates and will provide updates if and as they are made available.

Can we change our 2020 plan so that employees can carry over more than $550 to the upcoming plan year?

No, currently under published IRS guidelines, the FSA carryover provision allows a maximum of $550 to be rolled over from the current plan year to the following plan year. The IRS has not provided any additional guidance or changes to this policy since the onset of the COVID-19 crisis, but Navia is monitoring all regulatory updates and will provide updates if and as they are made available.

We have employees who recently made elections in their FSAs for planned dental or surgical procedures, and the provider facilities where those procedures were to be performed are now closed or have canceled all non-essential care during the crisis. Can these employees change or cancel their election, or can we extend our plan year to accommodate these employees?

There are no current provisions in the FSA regulations that allow changes/reductions in annual elections due to the lack or unavailability of specific providers. Employers who have not previously adopted either the FSA grace period or carryover provision in their plans may want to consider this as a means of helping employees in these situations. Employees may also want to consider using their funds for other needed medical services during this time.

Can employees on unpaid leave continue to fund their HCFSAs through contributions from their own bank account?

Yes. In this circumstance, employees should be made aware that they will not get the pre-tax withholding benefits associated with payroll contributions while they are in a leave status.

<<return to table of contents>>

Day Care Flexible Spending Accounts

We have employees whose children will not be attending school for the remainder of the school year and now require day care. Many employees will be asking family members to watch their child while at work. Can they still participate in the DCFSA, and can they use their account to pay their family member?

Yes, employees in this situation can still participate in your DCFSA plan and pay their family member to provide care for their children. The family member providing care cannot be the employee’s spouse and cannot be a dependent under the age of 19.

Are school and day care facility closures qualifying events that would allow participants to change their Day Care election, and how can I help them do this?

Yes, a change in day care provider is a qualifying status change event. Employers should make the appropriate deduction changes through their payroll provider and update the election with Navia through their normal data transfer processes (file feed, or the online through the Navia Employer Portal).

My daycare is closed and now I must enroll my child into a temporary pandemic daycare. Is this daycare center eligible and if so, can I change my dependent care election if need be?

Yes, daycare facilities established specifically in response to the COVID-19 crisis are eligible providers, and employees can make or change their DCFSA elections to pay for these services as described above.

My spouse is no longer working but he/she expects to go back to work soon. We don’t want to lose our spot at the daycare and are still paying a fee to reserve our spot, can I still participate in the dependent care FSA?

Indirect childcare expenses (deposits, registration fees, etc.) are eligible for reimbursement under a DCFSA plan as a function of providing actual care to your children. In the context of the question, Navia interprets fees to hold spots in day care facilities where your child attends to be eligible expenses under this definition. Claims for indirect childcare expenses become eligible for reimbursement once the spouse goes back to work and childcare with the provider has resumed.

My spouse is now working from home and our kids are no longer in daycare. We are contributing an equal amount all year long into our dependent care FSA. We have already incurred $5,000 in dependent care expenses with dates of service incurred before the kids stopped going to daycare. Can I still participate in my employer’s dependent care FSA and just send in claims from while they were still going to daycare?

Yes, you can claim and be reimbursed for eligible daycare expenses that have been incurred earlier in the plan year. You do not need to have children actively receiving childcare in order to submit claims for prior expenses.

Will an E-mail from a participant requesting a change in their DCFSA election suffice for documentation purposes?

Yes.

Will DCFSA participants who change their election be able to reinstate their original election later this year if school and/or day care facilities resume normal services?

Yes, as long as the reinstatement/change is consistent with their future use of eligible daycare services.

<<return to table of contents>>

Health Savings Account

Our company has many employees who have active payroll contributions to their HSAs. Can they change their contributions if they are facing reduced hours or temporary leave?

Yes, employees can change future payroll contributions to Health Savings Accounts (HSAs) at any time. Note that employees must be eligible and enrolled in qualifying high-deductible health plan (HDHP) in order to contribute to their HSAs.

OK, I understand that employees can change their HSA contributions at any time. Can we, though, change our EMPLOYER contributions/subsidies to HSA participants?

Yes, with a plan change to your HSA plan document and subsequent communication to your employees.

Can employees on unpaid leave continue to fund their HSAs through contributions from their own bank account?

Yes, provided that they remain enrolled in a qualified HDHP. In this circumstance, employees should be made aware that they will not get the pre-tax withholding benefits associated with payroll contributions while they are in a leave status.

What impact does the recently-announced deferral of the tax filing deadline to July 15th have on HSAs?

The Treasury Department and the IRS recently announced a deferral of the 2019 tax filing deadline to July 15th. With this announcement, the deadline to make contributions to your 2019 HSA have also been extended to July 15th. This also implies that Form 5498s for the 2019 tax year will not be made available until sometime after the filing deadline, likely in mid- to late August.

For a full list of questions and answers related to the IRS filing deadline extension, please click here: https://www.irs.gov/newsroom/filing-and-payment-deadlines-questions-and-answers?_cldee=cHNocmlkZXJAdGFiZW4uY29t&recipientid=contact-1c2b4b51e8d4e51180eb3863bb368b18-f443a4ea25cc4149a3419e6114bdbb64&esid=e97b04b5-126e-ea11-a811-000d3a4df348

Can employees use money from their HSAs to pay or be reimbursed for their COBRA health insurance premiums?

Yes.

<<return to table of contents>>

COBRA

Will a COBRA Qualified Beneficiary (QB) be enrolled in active coverage automatically because of these new Department of Labor Guidelines? Does a QB have active insurance coverage with the carrier if initial payment is not made within 45 days of enrollment?

No, under the new guidance, COBRA QBs have an extended payment timeline (Outbreak period + 45 days) for their premiums, but notification of enrollment to the QB’s insurance carrier will not occur until the QB’s initial premium payment is received. If QBs make their premium payment within the extended payment timeline, Navia will provide a retroactive enrollment notice to the insurance carrier.

Will a QB remain active with the carrier if monthly premium payments are not made?

No, the new guidance requires that we allow the QB an extended payment timeline (Outbreak period + 30 days) but does not require that they automatically have access to care during this time. To minimize risk, Navia will notify the insurance carrier to suspend active coverage 30 days after the payment due date if payment is not received. If the QB later makes payment within the extended coverage timeline, Navia will provide a retroactive enrollment notice to the insurance carrier.

Are there any announced relief plans (tax credits, subsidies, deferrals, etc.) to help people pay COBRA premiums?

On April 29, 2020, the Department of Labor released additional guidance related to the COVID-19 pandemic that extended the deadlines associated with many benefit plans subject to ERISA and HIPAA guidelines. Under the guidance, COBRA election and payment deadlines were suspended upon the declaration of the National Emergency on March 1, 2020. COBRA qualified beneficiaries now have until 60 days after the declared National Emergency to elect COBRA continuation coverage, and enrolled COBRA participants now have the same timeframe under which to make premium payments for coverage.

<<download Navia’s Employee Benefit Extensions Timeline>>

I want to offer subsidies to my COBRA Qualified Beneficiaries (QBs). How can I do that?

Subsidies can be added to QB accounts through our employer portal. If you have more than 10 subsidies to enter please contact us at 866-831-6221 or cobraclient@naviabenefits.com for a template and we will upload one for you.

With the increase in COVID-related terminations and eligibility status changes, how long is it taking to generate COBRA packets to my employees, if I submit new change events by EDI or via the online COBRA portal? What are the current timing expectations for mail delivery of COBRA packets?

COBRA packets are mailed within 1 business day after a qualified change event has been entered directly through the Navia COBRA portal. Submissions through EDI or spreadsheet will be processed within 2 business days after receipt, and packets will be delivered one day later. Navia has no specific information regarding disruptions or delays in mail delivery in different areas of the US as a result of the COVID-19 pandemic; please consult the US Postal Service web site and/or your local news sources for information.

Is Navia waiving the usual $5 fee charged to manually process new COBRA change notifications submitted by spreadsheet?

Yes, Navia is waiving the $5 manual processing fee during the COVID pandemic, provided that changes are submitted using the standard Navia template. Please contact cobraclient@navaibenefits.com if you need a copy of this template.

Do I need to expedite COBRA coverage for a high-need employee?

We notify carriers of enrollments the within the next business day after enrollment and after first payment is made by the QB. Carriers typically process notifications within 8-10 days. If a QB needs immediate medical care they should contact us at 877-920-9675 after they make their election and first payment. For those that do not have an immediate medical need we ask that you allow the carriers the appropriate amount of time to process.

Can Navia help me with my leave-of-absence (LOA) population?

We do offer LOA billing services and are able to help. Please contact sales@naviabenefits.com for more information.

Yes, Navia specializes in premium billing solutions for employers who need to collect premiums from employees who are on leaves of absence. Navia can assist employers who will be addressing significant increases in leaves in the coming months. Please click here for information and to provide your contact information, and a representative will contact you directly.

Can employees use money from their HSAs to pay or be reimbursed for their COBRA health insurance premiums?

Yes.

<<return to table of contents>>

Commuter Benefits

Can my employees who participate in our Commuter Benefits program change or cancel their existing transit and parking orders? Can they reinstate them when they come back to work?

Yes, Commuter Benefits as defined under Section 132 of the IRS code are changeable on a month-to-month basis and can be paused or reinstated based on each employee’s needs. Employees must make changes to their commuter order for the upcoming/future month by the 20th of the current month. See COVID Tips for additional information and guidance that Navia has provided to employees on this topic.

Can we cancel or temporarily suspend commuter orders on behalf of a group of employees who will be going on leave status or will no longer be working for us?

Yes; we recommend that you communicate with the employees prior to making the change. Navia can assist you with this action; please contact us at employerservices@naviabenefits.com.

<<return to table of contents>>

Health Reimbursement Arrangements

The recent DOL guidelines suspended the claims run-out periods for plans with a run-out in effect as of 3/1/2020. What will happen to forfeiture in these plans?

Forfeiture calculations for 2019 FSA and HRA plans will obviously be delayed because of the extended filing periods for claims. The actual date by which forfeitures will be calculated is uncertain until the federal government declares an end to the National Emergency and the exact length of the Outbreak Period will be known. Navia will promptly calculate FSA and HRA plan forfeiture amounts following the end of the Outbreak Period and will be communicating to employers accordingly.

Do I need to amend my FSA or HRA plan documents because of the suspension of the claims filing period?

Because the DOL guidance does not represent a meaningful change in benefits or costs in the plans, Navia’s general recommendation is that no plan document changes are required. If you or your compliance team have a common practice of documenting all changes to your benefit plans, you may download and complete our plan amendment template here. You can keep the completed amendment for your files, and you do not need to return a copy to Navia.

How does a change in an employee’s health care eligibility status affect their HRA’s?

Most HRA plans are defined as a component of the employee’s overall health care coverage, and eligibility for HRA reimbursement follows and aligns with the employee’s eligibility for health insurance. HRAs that are specifically designed to reimburse vision/dental and other non-medical services can have separate eligibility rules and are not linked to health insurance eligibility.

<<return to table of contents>>

Navia’s commitment to providing high-quality service has never been more important and we will continue to find ways to help during these difficult times. Please check back regularly for updates. Stay safe and healthy.

Check out our blog on the “Impact of the CARES Act on FSAs, HSAs, HRAs, and Related Services”